Payroll Outsourcing Services

- Seasoned Payroll Professionals with Decades of Expertise.

- Flexible Solutions Customized to Your Business Needs.

- Regulatory Compliance Assured with Up-to-Date Practices.

- Personalized Support with Dedicated Account Managers.

- Robust Security Measures for Protecting Payroll Data.

Key Services in Payroll Services in Delhi

Payroll Processing and Management

Efficiently handles employee wage calculations, deductions, and disbursements, ensuring timely and accurate payroll processing, which is critical for maintaining employee satisfaction and regulatory compliance.

Tax Filing and Compliance

Manages payroll tax calculations, withholdings, and timely filing with federal, state, and local authorities, reducing the risk of penalties and ensuring adherence to tax regulations.

Employee Benefits Administration

Administers employee benefits, including health insurance, retirement plans, and leave accruals, integrating them with payroll to streamline management and ensure accurate benefit calculations and deductions.

Payroll Reporting and Analytics

Provides detailed payroll reports and analytics, offering insights into labor costs, employee earnings, and tax liabilities, helping organizations make informed financial decisions and maintain compliance.

Why Do You Need To Outsource Payroll Services to Delhi?

Outsourcing payroll services offers several key benefits for businesses. First, it enhances accuracy, reducing errors in calculations and tax filings. Second, it saves time and resources, allowing your team to focus on core operations rather than payroll processing. Third, it ensures compliance with evolving labor laws and tax regulations, mitigating legal risks. Additionally, outsourcing often provides access to advanced technology and expertise without the overhead costs of maintaining an in-house team. Overall, it streamlines operations and enhances efficiency.

Customized & highly flexible payroll processing

Salary disbursement support

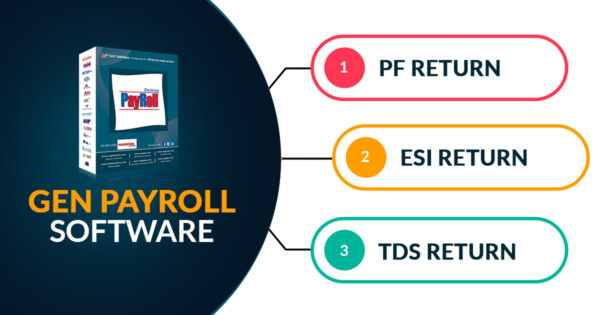

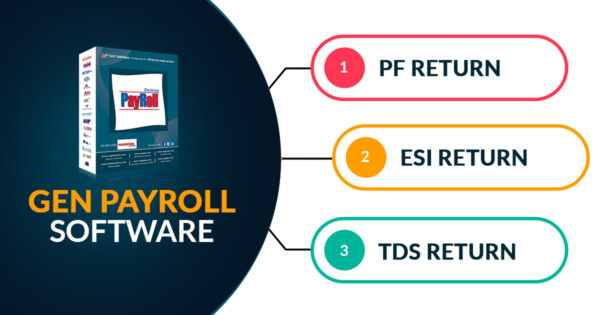

Obtain/amend ESI, EPF, and EPT codes

Generation of monthly statutory challans

Preparation and submission of statutory returns

Types of Payroll Services in Delhi

Compensation Consulting

Compensation consulting helps organizations design effective pay structures, ensuring fairness, compliance, and employee satisfaction. It optimizes payroll strategies, aligns with business goals, and addresses corporate tax planning, making it integral to efficient payroll management and sustainable organizational growth.

Internal Controls/Payroll Systems

Internal controls in payroll systems enhance financial accuracy by safeguarding sensitive data, preventing fraud, and ensuring regulatory compliance. They support robust payroll oversight, align with corporate governance, and enable organizations to deliver secure, efficient, and transparent payroll management solutions.

Paperless Services

Paperless services in payroll systems enhance operational efficiency by digitizing payroll processing, reducing errors, and improving compliance. They support seamless payroll management, align with strategic corporate tax planning, and enable payroll companies to deliver eco-friendly, accurate, and streamlined solutions for efficient payroll services.

Payroll Services for Corporate

Payroll services for corporate businesses streamline payroll management, ensuring compliance with company taxes, corporate tax planning, and business accounting and taxation. They optimize payroll processing, reduce errors, and help payroll companies provide efficient solutions for the management of payroll in organizations.

Benefits of Payroll Services in Delhi

Accuracy and Compliance

Professional payroll services ensure precise calculations and adherence to tax laws and regulations, reducing the risk of errors and penalties.

Time Savings

Automating payroll processes frees up time for businesses, allowing them to focus on core operations instead of administrative tasks.

Expertise and Support

Access to knowledgeable professionals who can handle complex payroll issues, answer questions, and provide strategic advice.

Cost Efficiency

Outsourcing payroll can be more cost-effective than maintaining an in-house payroll department, especially for small to mid-sized businesses.

Data Security

Payroll service providers implement robust security measures to protect sensitive employees and Frequently Asked Questions:financial data from breaches and fraud.

Scalability

Payroll services can easily adapt to changing business needs, including scaling operations up or down as your workforce grows or shrinks.

How is employee payroll data protected and kept secure?

Employee payroll data is protected through a combination of advanced security measures and compliance with data protection regulations to ensure confidentiality and integrity.

Data Encryption:

All payroll data is encrypted both in transit and at rest. This means that sensitive information is encoded during transfer and storage, making it inaccessible to unauthorized parties.

Access Controls:

Strict access controls are implemented, with role-based permissions limiting access to payroll data. Only authorized personnel with specific roles can access or modify payroll information.

Regular Audits and Monitoring:

Continuous monitoring and regular security audits are conducted to detect and address potential vulnerabilities or breaches. This proactive approach helps maintain the security of payroll data.

Compliance with Regulations:

Adherence to data protection regulations such as GDPR, CCPA, and HIPAA is maintained. This includes ensuring that payroll practices align with legal requirements for data protection and privacy.

Data Backup and Recovery:

Regular data backups are performed to safeguard against data loss. Additionally, robust recovery procedures are in place to restore data in the event of a system failure or cyber incident.

These measures collectively ensure that employee payroll data remains secure and compliant with applicable regulations, protecting both the organization and its employees.

Frequently asked questions on payroll services:

Payroll services typically include salary and wage calculations, tax withholdings, deductions, and employee benefits administrations.

Payroll services improve accuracy, ensure compliance, save time, enhance data security, and provide expert support, ultimately reducing administrative burdens and costs.

Consider factors such as the provider’s reputation, range of services, technology capabilities, cost, customer support, and how well they integrate with your existing systems.

Costs vary based on the provider, the size of your business, and the complexity of your payroll needs. Providers may charge a flat fee, per-employee fee, or a combination.

Payroll services stay updated with current tax regulations and handle tax calculations, withholdings, and filings to ensure compliance and minimize the risk of penalties.

Partner with us for efficient, accurate, and compliant payroll solutions tailored to your business needs. Experience the benefits of expert management, robust security, and seamless integration. Contact us today to simplify your payroll processes and focus on what matters most—growing your business.

ACATL’s payroll services in Delhi offer businesses a streamlined and efficient way to manage employee compensation, tax deductions, and compliance with local labor laws. By outsourcing payroll to ACATL, businesses in Delhi can save time, reduce errors, and ensure timely payments to employees, while also staying compliant with regulatory requirements. Our services are tailored to meet the specific needs of Delhi-based businesses, providing hassle-free payroll management so companies can focus on growth and productivity.