Understanding Payroll Services for Small Business in Delhi

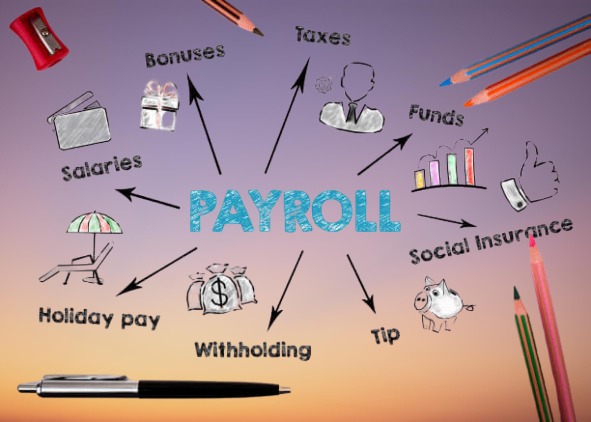

Payroll services play a crucial role in managing employee payments, tax deductions, and ensuring compliance with labor laws. For businesses of all sizes, managing payroll accurately and efficiently is vital, as it directly affects employee satisfaction, legal compliance, and overall operational efficiency. Effective payroll services ensure employees receive timely compensation while maintaining compliance with regulatory requirements, such as tax filings, social security contributions, healthcare benefits, and retirement savings.

In the modern business landscape, payroll processing has become more than just calculating salaries. It involves a complex array of tasks including withholding taxes, tracking paid time off (PTO), managing sick leave, handling bonuses, and calculating overtime. Additionally, it ensures businesses remain compliant with the ever-changing tax laws and labor regulations imposed by local, state, and federal authorities. Even small errors in payroll can result in hefty penalties or a loss of employee trust. This has led many businesses to either adopt advanced payroll management software or outsource payroll services in Delhi to specialized providers who can handle the complexity efficiently.

The Importance of Payroll Services in Delhi

Payroll services are designed to automate and simplify the process of paying employees. For employers, managing payroll in-house can be overwhelming due to the multiple moving parts, including updating employee information, processing new hires or terminations, adjusting for benefits or deductions, and ensuring compliance with payroll tax regulations.

Effective payroll management not only ensures timely compensation for employees but also helps the business maintain a positive reputation. A company that consistently delivers accurate and on-time payments fosters trust and loyalty among employees. It also improves employee morale, leading to better productivity and job satisfaction. Moreover, payroll services help maintain transparency between the employer and employees, as detailed payroll records can provide insights into salary breakdowns, deductions, and benefits.

Beyond internal benefits, payroll services also protect businesses from non-compliance with tax and labor regulations. Errors in tax withholdings or missed filings can lead to costly penalties, legal issues, or damage to the company’s reputation. Payroll services mitigate these risks by automating tax calculations, filing deadlines, and other compliance-related tasks, ensuring that the business remains in line with the latest laws and standards.

The Decision to Outsource Payroll Services

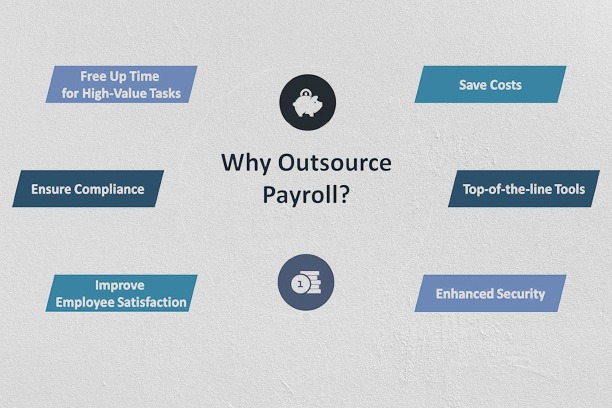

Many businesses, especially those with limited internal resources, opt to outsource payroll services to specialized third-party providers. Outsourcing payroll can be an attractive option for businesses that want to streamline their operations and focus more on core business activities without the burden of handling complex payroll tasks.

Outsourcing payroll services offers several advantages, including:

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

- Time Savings: Payroll management is a time-consuming process. By outsourcing, businesses free up valuable time that can be spent on strategic activities such as growth initiatives, client relationships, and revenue generation.

- Cost Savings: While outsourcing may come with a cost, it can often be more cost-effective than maintaining an in-house payroll department. The cost of payroll software, training, salaries for payroll staff, and the time spent on payroll processes can quickly add up, making outsourcing a more economical solution.

- Access to Expertise: Payroll service providers are experts in tax laws, compliance regulations, and labor laws. These professionals stay up-to-date with changes in tax laws and labor regulations, ensuring that businesses remain compliant. For companies that don’t have in-house tax or legal expertise, this access can be invaluable.

- Accuracy and Reduced Errors: Human errors are common in payroll processing, especially in businesses with complex payment structures, multiple pay cycles, and varying employee classifications (salaried, hourly, freelance, etc.). Payroll service providers use sophisticated systems and processes to reduce errors, ensuring accurate and timely payroll processing.

- Compliance with Changing Regulations: Payroll regulations are continually changing, and it can be difficult for businesses to keep up. Payroll providers specialize in staying current with these changes, helping businesses avoid fines and penalties from non-compliance.

- Data Security: Payroll data contains sensitive information such as employee social security numbers, salaries, and tax information. Outsourcing payroll to a reputable provider ensures that this sensitive data is protected by high-level encryption and secure data management practices, reducing the risk of data breaches or identity theft.

Key Features of Payroll Services in Delhi

Both in-house and outsourced payroll services offer various features that help businesses manage payroll efficiently. These features ensure that payroll is processed accurately, on time, and in full compliance with legal requirements:

- Salary Calculations: Payroll services automatically calculate employee wages based on working hours, overtime, and bonuses, ensuring employees are paid correctly. They also account for various deductions such as taxes, benefits, retirement contributions, and garnishments.

- Tax Deductions and Filing: Payroll services calculate the correct amount of tax to be withheld from employee paychecks and ensure that taxes are filed correctly with the appropriate authorities. This includes federal, state, and local taxes, as well as social security and Medicare contributions.

- Compliance Management: Payroll services help businesses remain compliant with tax laws and labor regulations by tracking changes to local, state, and federal laws. They also assist in ensuring the business complies with overtime pay, minimum wage requirements, and other employment standards.

- Real-Time Reporting: Payroll services offer detailed reporting features that provide businesses with an overview of payroll expenses, employee earnings, tax filings, and benefit contributions. Real-time reporting helps businesses stay organized and make informed decisions regarding financial planning and workforce management.

- Direct Deposit: Many payroll services offer direct deposit options, allowing employees to receive their payments electronically, rather than through paper checks. This method is faster, more secure, and environmentally friendly.

- Employee Self-Service Portals: Many payroll providers offer online portals where employees can access their payslips, tax documents, and update personal information. This reduces the administrative burden on HR departments and provides employees with transparency over their own payroll records.

- Time and Attendance Tracking: Integration with time-tracking systems allows payroll services to automatically calculate wages based on the actual hours worked, including overtime, vacation, sick leave, or other paid time off.

- Benefits Administration: Payroll services also manage employee benefits such as health insurance, retirement savings, and other voluntary deductions. This simplifies the process for employers and ensures that employee benefits are accurately accounted for in payroll.

In-House vs. Outsourced Payroll Services

Deciding whether to manage payroll in-house or outsource it to a provider depends on several factors, including the size of the business, the complexity of its payroll processes, and the resources available for handling payroll in-house.

Outsourced Payroll Management: For smaller businesses, startups, or companies without the resources to handle payroll internally, outsourcing payroll services can be a cost-effective solution. Outsourced providers offer expertise, reduce the risk of errors, and free up time for business owners to focus on growth. Outsourced payroll services are often scalable, making them ideal for growing businesses that expect to expand their workforce over time.

In-House Payroll Management: This is often preferred by larger businesses with dedicated HR or payroll departments. Companies that manage payroll in-house typically use payroll software to automate calculations and record-keeping. However, this approach requires a skilled payroll team and regular updates to stay compliant with new regulations.

Benefits of Outsourcing Payroll Services

Outsourcing payroll services offers several advantages for businesses of all sizes. Here are some key benefits:

- Time and Cost Savings: Managing payroll in-house can be time-consuming and requires dedicated resources. Outsourcing allows companies to focus on their core operations while professionals handle payroll, reducing administrative burdens and costs.

- Compliance with Regulations: Payroll outsourcing providers stay updated on the latest tax laws, labor regulations, and compliance requirements, reducing the risk of errors, penalties, or legal issues related to payroll.

- Improved Accuracy: Professional payroll services use specialized software and expertise to ensure accurate salary calculations, deductions, and tax filings, minimizing mistakes.

- Data Security: Outsourcing to a reputable provider ensures the security of sensitive employee data through advanced encryption and data protection measures.

- Access to Expertise: Payroll providers often offer expert insights into tax regulations, labor laws, and employee benefits, ensuring businesses comply with ever-changing laws and best practices.

- Scalability: As businesses grow, outsourced payroll services can easily adapt to accommodate increasing employee numbers or changes in payroll complexities.

Outsourcing payroll streamlines operations, reduces errors, and helps businesses maintain focus on growth while ensuring compliance and employee satisfaction.

What features do payroll outsourcing providers offer?

Payroll outsourcing providers offer a range of features designed to simplify and streamline payroll management for businesses. Key features typically include:

- Payroll Processing: Automated salary calculations, including deductions, bonuses, and overtime payments, ensuring accurate and timely payroll processing.

- Tax Filing and Compliance: Calculation and filing of payroll taxes, including federal, state, and local taxes. Providers ensure compliance with tax laws and regulations to avoid penalties.

- Direct Deposit: Facilitating direct deposit of employee salaries into their bank accounts, eliminating the need for manual checks and enhancing convenience for employees.

- Employee Self-Service Portals: Many providers offer portals where employees can access their payslips, tax documents, and update personal information like bank details and addresses.

- Time and Attendance Tracking: Integration with time-tracking systems to streamline payroll based on hours worked, overtime, or leave taken.

- Benefits Administration: Management of employee benefits such as health insurance, retirement plans, and other deductions related to employee benefits.

- Compliance Management: Assistance with staying compliant with labor laws, tax regulations, and industry standards, including handling audits and regulatory changes.

- Custom Reports: Generation of detailed reports on payroll expenses, employee salaries, tax filings, and benefits, helping businesses with financial planning and audits.

- Data Security: Advanced encryption and security measures to protect sensitive employee and company information, reducing the risk of data breaches.

- Scalability: Ability to handle payroll changes as businesses grow, whether it’s expanding the workforce or adapting to new compliance requirements in different regions.

- Customer Support: Expert support to handle payroll queries, employee issues, and troubleshooting for employers, often through dedicated account managers or support teams.

These features help businesses manage payroll efficiently, reduce errors, ensure compliance, and focus on their core operations.

Choosing the Right Payroll Service Provider in Delhi

Choosing the right payroll service provider is a critical decision for businesses, as it directly impacts the efficiency, accuracy, and compliance of payroll processing. Here are some key factors to consider when selecting the right payroll provider:

1. Service Offerings

Comprehensive Solutions: Ensure the provider offers all the services you need, such as payroll processing, tax filing, benefits management, and compliance support.

Scalability: Choose a provider that can scale with your business, whether you have a small team now or plan to expand in the future.

2. Compliance Expertise

Tax and Labor Law Compliance: The provider should stay updated with changing federal, state, and local tax laws, ensuring your business complies with all regulations.

Industry-Specific Knowledge: Some industries have unique payroll requirements. A provider with experience in your industry can help navigate these complexities.

3. Technology and Integration

User-Friendly Software: Ensure the payroll software is easy to use and offers features like automated calculations, direct deposit, and employee self-service portals.

Integration with Existing Systems: The provider’s system should integrate seamlessly with your accounting, time-tracking, and HR systems to avoid manual data entry and reduce errors.

4. Data Security

Encryption and Data Protection: Payroll data contains sensitive information. The provider should have robust security protocols in place, such as encryption, secure data storage, and disaster recovery plans.

Compliance with Data Protection Laws: Ensure they adhere to data protection regulations, like GDPR or HIPAA, if applicable.

5. Customer Support

Responsive and Accessible Support: Choose a provider that offers reliable customer support through multiple channels (phone, email, chat) and during hours that suit your business.

Dedicated Account Manager: Having a dedicated representative who understands your business needs can significantly enhance service quality.

6. Cost and Pricing Structure

Transparent Pricing: Look for a provider with clear pricing models, avoiding hidden fees for additional services like tax filings, reporting, or customer support.

Cost vs. Service Value: Compare the cost of the service with the value and features offered, ensuring the provider meets your needs without exceeding your budget.

7. Reputation and Experience

Track Record: Check reviews, testimonials, and case studies to ensure the provider has a solid reputation for accuracy, reliability, and compliance.

Industry Experience: Experience in handling payroll for businesses of your size or industry can be a strong indicator of a provider’s competence.

8. Customization and Flexibility

Tailored Solutions: A good provider should offer flexibility to customize their services to meet your specific payroll needs, such as handling different pay structures or benefits.

Growth Flexibility: The provider should accommodate changes like adding new employees, handling different employee classifications, and expanding to new locations.

9. Reporting and Analytics

Detailed Reporting: Look for a provider that offers comprehensive reporting features, including payroll summaries, tax filings, and custom reports that can help in audits and strategic decision-making.

Data Insights: Some providers offer analytics tools to help you track trends in payroll costs, employee benefits usage, and overtime.

10. Trial Period or Demos

Test the System: Many payroll service providers offer demos or trial periods, allowing you to test the system’s ease of use and features before committing to a long-term contract.

By evaluating these factors, you can choose a payroll service provider that aligns with your business needs, ensuring smooth, compliant, and efficient payroll management.

Payroll Services in Delhi

ACATL is a leading payroll services provider in Delhi, specializing in comprehensive solutions for regulatory compliance and risk management. Their services ensure that businesses adhere to legal requirements while optimizing operational efficiency and minimizing risks.

(FAQs) about outsourcing payroll services:

1. What is payroll outsourcing?

Answer: Payroll outsourcing involves hiring an external service provider to manage your company’s payroll processing, including calculating employee wages, tax withholdings, filing taxes, and ensuring compliance with relevant laws and regulations.

2. Why should a business outsource payroll services?

Answer: Businesses outsource payroll services to save time, reduce errors, stay compliant with tax and labor laws, reduce administrative burdens, and focus on core business activities. It also helps to mitigate the risks of penalties due to payroll mistakes or late filings.

3. What services do payroll outsourcing providers typically offer?

Answer: Providers typically offer services such as payroll processing, tax calculations, tax filings, employee benefits administration, direct deposit management, compliance support, and detailed payroll reporting.

4. How much does it cost to outsource payroll services?

Answer: The cost varies depending on the size of your business, the complexity of payroll needs, and the range of services you require. Many providers offer tiered pricing, with charges based on the number of employees and the services included.

5. Is payroll outsourcing suitable for small businesses?

Answer: Yes, small businesses can greatly benefit from outsourcing payroll as it allows them to focus on growing their business while ensuring that payroll is handled accurately, efficiently, and in compliance with tax regulations.

6. How secure is payroll outsourcing?

Answer: Reputable payroll service providers use advanced security protocols, such as encryption, secure data centers, and compliance with data protection regulations (e.g., GDPR, HIPAA), to ensure your payroll data is kept secure and confidential.

7. Can I customize payroll outsourcing services to fit my business needs?

Answer: Yes, most payroll service providers offer customizable solutions based on your business’s specific needs, including handling different pay structures, benefits packages, and compliance with local regulations.

8. How does outsourcing payroll help with compliance?

Answer: Payroll outsourcing providers stay up-to-date with changing tax and labor laws to ensure your business remains compliant with government regulations, minimizing the risk of fines or penalties for errors or late filings.

9. What is the process for transitioning to an outsourced payroll provider?

Answer: Transitioning to an outsourced payroll provider typically involves gathering employee data, setting up payroll preferences, integrating payroll with time-tracking or HR systems, and conducting an initial trial run to ensure accuracy.

10. What happens if a payroll mistake occurs with an outsourced provider?

Answer: Reputable payroll providers usually offer guarantees to rectify mistakes quickly. Additionally, many providers assume liability for any errors in tax filings or payroll processing that result in penalties, offering peace of mind to the business.

11. How do I choose the right payroll outsourcing provider?

Answer: To choose the right provider, evaluate their service offerings, experience, reputation, pricing structure, security measures, and customer support capabilities. It’s also important to select a provider that can scale with your business as it grows.

12. Can I still control certain aspects of payroll if I outsource?

Answer: Yes, many payroll outsourcing services offer flexible options that allow you to maintain control over certain payroll aspects, such as approving final payroll amounts or deciding on employee benefits packages.

13. How often are payroll taxes filed by an outsourced payroll provider?

Answer: Payroll taxes are typically filed according to federal, state, and local regulations. This could be on a quarterly or annual basis, depending on the jurisdiction. Your provider will ensure compliance with all applicable tax deadlines.

14. How quickly can I start using an outsourced payroll service?

Answer: The time it takes to fully implement an outsourced payroll service varies but can often be completed within a few days to a few weeks, depending on the complexity of your payroll and the provider’s setup process.