Accounting Outsourcing

- Expert Accountants with 25+ years of Experience.

- Scalable services tailored to your needs.

- Advanced accounting tools for real-time data.

- Regulatory requirements managed to ensure compliance.

- Dedicated Support for Personalized client service and communication.

- Secure Systems with Robust protection of financial data.

Key Services in Accounting Outsourcing in Delhi

Bookkeeping

Systematic recording of daily financial transactions, maintaining ledgers, performing reconciliations, and preparing detailed financial statements for accurate tracking of business finances.

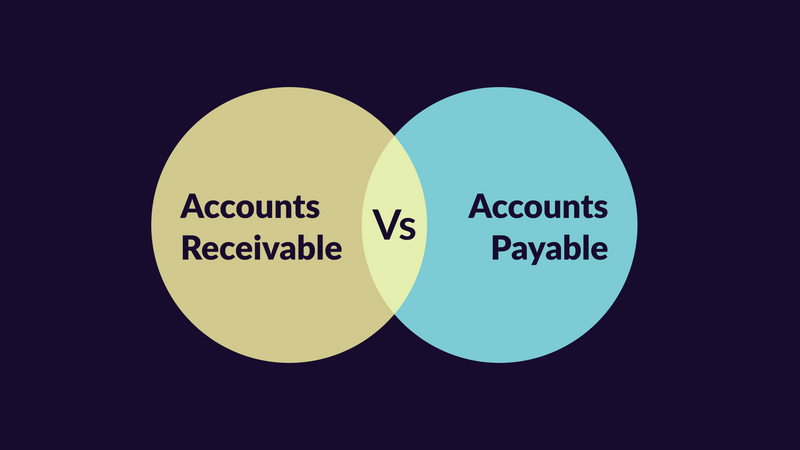

Accounts Payable and Receivable

Efficiently managing and processing invoices, coordinating payments, and overseeing collections to maintain optimal cash flow and financial stability.

Financial Reporting

Creating precise financial statements such as balance sheets and income statements, along with cash flow reports, to provide clear, timely insights into a company’s financial health.

Tax Compliance and Planning

Ensuring compliance with tax laws, preparing and submitting tax returns, and developing strategic plans to reduce tax liabilities and optimize financial efficiency.

What accounting services are provided to clients in Delhi?

ACATL delivers comprehensive accounting and financial solutions tailored to your business in and from Delhi. From intricate tax strategies to precise payroll management, our expert team provides personalized support. With a focus on accuracy and efficiency, we handle the complexities of your finances, allowing you to concentrate on business growth. Leveraging our deep industry knowledge, ACATL offers strategic financial insights to drive your success.

Accounting for Startups and SMEs

TDS/TCS compliance

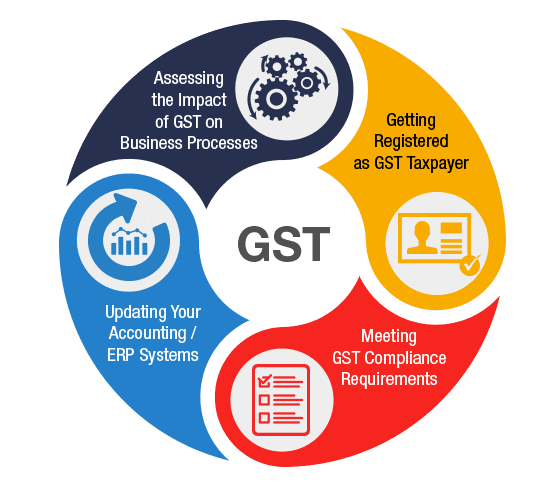

GST Compliance

Accounts Payable and Receivable

Audit Support Service

Payroll Processing

Inventory Management

Preparation of Financial Statements

Year-End Services

Advantages of Outsourcing Accounting Services in Delhi:

Cost Savings:

Outsourcing accounting services eliminates the need for a full-time in-house team, significantly reducing payroll, training, and overhead costs. Businesses save on salaries, benefits, and office space, which can be reinvested into other areas of growth.

Expertise:

By outsourcing, companies gain access to a team of highly skilled accounting professionals who possess specialized knowledge and experience. These experts are well-versed in the latest accounting practices, tax regulations, and industry standards, ensuring high-quality financial management.

Accuracy:

Professional accounting firms use advanced software and systems to manage financial data, which reduces the likelihood of errors. Their adherence to rigorous compliance standards ensures accurate financial reporting and adherence to regulatory requirements, minimizing costly mistakes.

Time Efficiency:

Outsourcing accounting functions allows businesses to delegate routine and complex financial tasks, freeing up internal resources and staff. This enables the company to concentrate on its core operations, strategic planning, and growth initiatives without being bogged down by administrative tasks.

Scalability:

Outsourced accounting services can easily scale up or down based on the company’s needs, such as during periods of growth or seasonal fluctuations. This flexibility eliminates the challenges associated with hiring, training, and managing additional in-house staff.

Risk Management:

Outsourced accounting firms provide enhanced financial oversight and internal controls, reducing risks related to compliance, fraud, and financial mismanagement. Their expertise helps identify and address potential issues proactively, safeguarding the company’s financial health.

Outsourced accounting services can easily scale up or down based on the company’s needs, such as during periods of growth or seasonal fluctuations. This flexibility eliminates the challenges associated with hiring, training, and managing additional in-house staff.

How to Choose the Right Outsourcing Partner for Accounting Services

Choosing the right outsourcing partner for your accounting services is critical for maintaining financial accuracy, compliance, and efficiency. Here’s a structured approach to make an informed decision:

Assess Expertise and Experience:

Evaluate potential partners based on their industry experience and expertise in accounting. Look for firms with a proven track record and relevant certifications. They should demonstrate proficiency in handling financial tasks similar to your business’s needs.

Check Reputation and References:

Research the outsourcing firm’s reputation by reading client reviews and seeking references. Positive feedback and successful case studies indicate reliability and client satisfaction. A firm with a solid reputation is more likely to deliver quality services.

Evaluate Technology and Tools:

Ensure the firm utilizes modern accounting software and technology. Advanced tools can streamline processes, enhance accuracy, and integrate seamlessly with your existing systems. Verify that their technology meets industry standards for data security and efficiency.

Understand Cost Structure and Value:

Compare pricing models and understand what’s included in the cost. While lower costs can be attractive, prioritize the overall value and quality of service. Transparent pricing without hidden fees is essential for budgeting and financial planning.

Consider Communication and Support:

Effective communication is vital for a successful partnership. Choose a firm that offers responsive and proactive support. Regular updates and open channels for addressing issues are crucial for maintaining a smooth workflow.

Ensure Compliance and Security:

Verify that the partner adheres to regulatory requirements and industry standards. They should have strong data protection measures to safeguard your financial information and ensure compliance with relevant laws.

By focusing on these key factors—expertise, reputation, technology, cost, communication, and compliance—you can select an outsourcing partner that aligns with your business needs and enhances your accounting functions effectively.

Frequently Asked Question on Accounting Services

Accounting outsourcing is the practice of hiring an external firm to handle your business’s accounting and financial functions. Instead of maintaining an in-house accounting department, you delegate these tasks to specialized professionals

Engaging in outsourcing may lead to cost reductions, provide access to specialized expertise, enhance accuracy, improve compliance, and enable your business to concentrate on its core activities.

Common services encompassed within accounting outsourcing typically comprise accounts payable and receivable, financial reporting, payroll processing, audit support services, tax preparation, and regulatory compliance.

It is advisable to consider various factors such as industry experience, service offerings, reputation, and client feedback when selecting an accounting outsourcing provider.

Reputable providers implement stringent security protocols, including data encryption and secure access controls, to safeguard your financial information.

Outsourcing accounting services in Delhi offers several benefits to businesses. It allows companies to focus on core activities while leaving complex accounting tasks to professionals. By outsourcing, businesses in Delhi can access expert accountants without the need for full-time hires, reducing operational costs. Additionally, it ensures accurate financial management, timely reporting, and compliance with local tax regulations, all of which are crucial for businesses to grow and maintain financial health in a competitive market like Delhi.