Assurance & Attestation Service

- Your Trustworthy Partner in Assurance and Attestation

- Trusted Expertise in Providing Reliable Attestation Services

- Customized Solutions to Fit Your Unique Requirements

- Serving Clients Across Borders with Expertise

- Confidential & Secure data protection

- Client-Focused: Personalized and Responsive support

- Certified Professionals: Experienced and credentialed team

Key Services in Assurance & Attestation Services in Delhi

Financial Statement Audits

Verifies financial statements for accuracy and compliance with accounting standards. Assesses internal controls to ensure reliable reporting and provide stakeholders with trustworthy financial information.

Internal Control Reviews

Evaluates internal controls to identify weaknesses and ensure effective risk management. Enhances operational efficiency and compliance, contributing to stronger governance and organizational success.

Regulatory Compliance Assurance

Confirms adherence to relevant laws and regulations through independent verification. Reduces risk and boosts credibility by ensuring your organization meets all required compliance standards.

Performance Audits

Assesses the effectiveness and efficiency of operations or programs. Focuses on resource utilization and outcomes to improve organizational performance and achieve strategic goals.

What Assurance & Attestation Services are provided to clients in Delhi?

At Acatl, we take pride in offering exceptional attestation and assurance services through our team of highly skilled chartered accountants(CAs). With their expertise, we perform thorough audits, meticulously review financial statements, and assess internal controls to guarantee not just accuracy but also unwavering compliance and reliability. By choosing us, you not only gain trust but also ensure strict adherence to the regulatory compliance essential for your success.

Statutory Audit as per the Companies Act

We provide thorough statutory audits under the Companies Act, ensuring your financial statements comply with legal requirements and accounting standards. Our expert auditors provide an Independent opinion financial reports, enhancing their reliability for stakrholders.

Tax audit as per the Income Tax Act

Our tax audit services help you meet Income Tax Act requirements by verifying the accuracy of your tax-related financial information. We ensure compliance with tax laws and identify potential tax optimization opportunities.

Certifications as per the business needs of the orginazations

We provide tailored certification services to meet your unique business requirements. Whether you need certifications for internal purposes, stakeholder assurance, or regulatory compliance, our team delivers accurate and timely certifications to support your business objectives.

Advantages of Assurance & Attestation Services

Enhanced Credibility and Trust

Independent verification boosts stakeholder confidence, ensuring the integrity of financial and non-financial information, which strengthens your organization’s reputation and reliability.

Improved Risk Management

Early identification of risks, such as compliance or financial issues, allows for proactive mitigation, reducing potential errors, penalties, and enhancing decision-making.

Regulatory Compliance

Ensures adherence to industry regulations and legal standards, minimizing the risk of penalties, fines, and reputational damage, enabling smooth and compliant operations.

Operational Efficiency

Identifies inefficiencies in internal controls and processes, leading to cost savings, better resource allocation, and improved organizational performance.

How to Choose the Right Outsourcing Partner for Assurance & Attestation Services

Choosing the right outsourcing partner for attestation and assurance services is critical for ensuring the accuracy, compliance, and integrity of your financial and operational processes. Here’s a concise guide to help you make an informed decision:

Assess Expertise and Experience:

Look for a firm with significant experience in your industry and a proven track record of serving similar clients. Ensure their team includes qualified CAs, which indicate a high level of expertise.

Evaluate Reputation and References:

Research the firm’s reputation through client testimonials, case studies, and online reviews. Speak directly with past clients to gauge their satisfaction with the services provided. A strong reputation suggests reliability and consistent quality.

Review Service Offerings:

Ensure the firm offers a comprehensive range of attestation and assurance services that meet your needs, such as financial audits and internal control reviews. A full-service provider can offer a more integrated approach.

Consider Technological Capabilities:

Assess the firm’s use of advanced technology, such as data analytics and AI, to enhance service efficiency and accuracy. Firms with cutting-edge tools can deliver more precise results and better risk management.

Check Compliance and Security Standards:

Ensure the firm adheres to stringent compliance and data security standards, which are crucial for protecting your sensitive financial and operational information.

By carefully considering these factors, you can select an outsourcing partner who will not only meet your immediate needs but also support your organization’s long-term goals.

Frequently Asked Questions on Assurance & Attestation Services

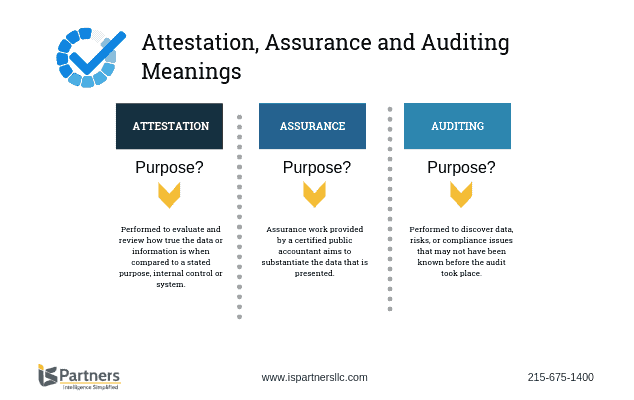

Assurance services evaluate the accuracy and reliability of information, while attestation services involve providing a formal opinion on financial statements or other reports.

Assurance services encompass a broad range of evaluations, including reviews and agreed-upon procedures. Attestation services specifically involve providing a formal opinion or report on the accuracy or completeness of a particular assertion made by another party, such as an audit report confirming the fairness of financial statements.

They enhance the credibility of financial reports, help ensure regulatory compliance, and improve decision-making by providing reliable and accurate information.

Chartered Accountants (CAs) or specialized audit firms perform assurance and attestation services.

Common types include audits, reviews, and agreed-upon procedures, each offering varying levels of assurance.

Assurance and Attestation Services can greatly benefit companies in Delhi by providing independent verification of financial statements and internal controls. These services help businesses ensure the accuracy and reliability of their financial reporting, which is essential for gaining trust from investors, regulatory authorities, and stakeholders. In Delhi’s competitive business environment, such services can enhance a company’s credibility, ensure compliance with local regulations, and support better decision-making based on verified financial data.