How Technology is Revolutionizing

Regulatory Compliance Management

Regulatory compliance management has long been a cornerstone of organizational governance, ensuring adherence to laws, standards, and ethical practices. Traditionally, managing compliance involved manual processes, extensive paperwork, and time-consuming audits. However, technology is revolutionizing the compliance landscape, streamlining processes, enhancing accuracy, and reducing costs.

In this blog, we delve into how technology is transforming regulatory compliance management, the challenges it addresses, the tools available, and the future trends shaping this evolution.

Understanding Regulatory Compliance Management

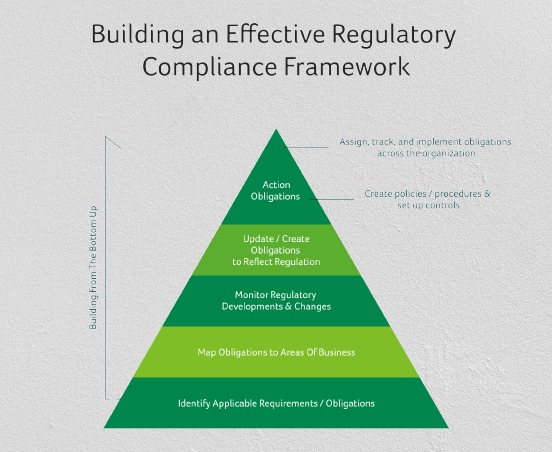

Regulatory compliance management ensures organizations operate within the bounds of laws, regulations, and industry standards. It involves:

• Monitoring changing regulations.

• Implementing policies and procedures.

• Conducting audits and assessments.

• Training employees and reporting compliance.

Failure to comply can lead to severe consequences, including legal penalties, financial losses, and reputational damage. With the increasing complexity of regulations and globalization, organizations are turning to technology to stay compliant.

Challenges in Traditional Compliance Management

1. Regulatory Complexity

Globalization has expanded the scope of compliance, requiring organizations to adhere to varying laws across jurisdictions.

2. Manual Processes

Paper-based workflows and manual record-keeping are prone to errors, inefficiencies, and delays.

3. High Costs

Compliance management often requires significant investment in resources, training, and legal expertise.

4. Dynamic Regulatory Environment

Frequent updates to laws and standards demand constant monitoring and adaptation.

5. Data Security Risks

Organizations must safeguard sensitive information against breaches, requiring robust systems and processes.

The Role of Technology in Compliance Management

1. Automation of Processes

Automation reduces the manual workload by handling repetitive tasks such as data entry, policy tracking, and reporting. Tools like Robotic Process Automation (RPA) streamline workflows, ensuring accuracy and saving time.

2. Real-Time Monitoring and Alerts

Compliance management software integrates with business systems to provide real-time monitoring of activities. Automated alerts notify teams of potential non-compliance, enabling swift corrective actions.

3. Data Management and Analytics

Technology enables the storage, organization, and analysis of vast amounts of compliance-related data. Advanced analytics tools identify trends, risks, and opportunities, helping organizations make informed decisions.

4. Enhanced Audit and Reporting Capabilities

Compliance tools simplify the auditing process by generating accurate and comprehensive reports. They maintain detailed logs of activities, making it easier to prepare for regulatory inspections.

5. Cybersecurity Integration

As data breaches become a critical concern, compliance technologies integrate cybersecurity measures such as encryption, multi-factor authentication, and intrusion detection systems to safeguard sensitive information.

Key Technologies Revolutionizing Compliance Management

1. Artificial Intelligence (AI)

AI powers intelligent compliance tools capable of:

• Predictive Analysis: Identifying potential compliance risks before they materialize.

• Natural Language Processing (NLP): Analyzing legal texts and regulations to extract actionable insights.

• Document Review: Scanning contracts and policies for inconsistencies or violations.

2. Machine Learning (ML)

ML algorithms learn from historical data to improve risk assessment and anomaly detection. They adapt to evolving compliance requirements, offering dynamic solutions.

3. Blockchain Technology

Blockchain ensures secure and transparent record-keeping by creating immutable transaction records. This is particularly valuable in industries like finance and healthcare, where traceability and authenticity are critical.

4. Cloud-Based Solutions

Cloud platforms offer scalability, enabling organizations to store and access compliance data from anywhere. They facilitate collaboration across teams and support integration with other software.

5. Internet of Things (IoT)

In sectors like manufacturing and energy, IoT devices monitor operational compliance by tracking metrics such as emissions, temperature, and equipment performance in real-time.

6. Compliance Management Software

Dedicated platforms like MetricStream, NAVEX Global, and SAP GRC provide end-to-end solutions for compliance management, covering policy creation, risk management, and reporting.

How Technology Solves Compliance Challenges

1. Keeping Up with Regulatory Changes

Regulatory compliance platforms include automated regulatory feeds that update organizations on changes in laws and standards, ensuring they stay ahead of requirements.

2. Reducing Costs

Automation and digitization lower the costs associated with manual processes, audits, and penalties for non-compliance.

3. Enhancing Accuracy and Consistency

AI and ML eliminate human errors, ensuring compliance activities are performed consistently and accurately across the organization.

4. Improving Transparency

Blockchain and advanced reporting tools enhance transparency by providing verifiable audit trails and documentation.

5. Scaling Compliance Efforts

Cloud-based solutions enable organizations to scale compliance operations, supporting growth into new markets and regulatory environments.

Case Studies: Technology in Action

1. Financial Sector

A multinational bank implemented AI-driven compliance software to monitor transactions for money laundering risks. The system flagged anomalies in real-time, reducing regulatory penalties and enhancing the bank’s reputation.

2. Healthcare Industry

A hospital used a cloud-based compliance platform to manage patient data under HIPAA regulations. The software ensured data security, automated reporting, and compliance with privacy laws, saving time and reducing risk.

3. Manufacturing

A manufacturing company employed IoT sensors to track emissions and operational parameters. The real-time data enabled the company to meet environmental standards and avoid penalties for non-compliance.

Future Trends in Compliance Technology

1. RegTech Evolution

RegTech (Regulatory Technology) is emerging as a specialized domain, offering innovative tools to address compliance challenges across industries.

2. AI-Powered Regulation Interpretation

Future tools will leverage AI to interpret complex regulations, translating them into actionable steps for organizations.

3. Predictive Compliance

Advanced analytics and ML will shift compliance from reactive to proactive, predicting risks and suggesting preventive measures.

4. Global Standardization

Technology will drive efforts to harmonize regulations across jurisdictions, reducing the complexity of compliance for multinational organizations.

5. Sustainability Compliance

Environmental, Social, and Governance (ESG) reporting is becoming a compliance priority. Technology will play a pivotal role in tracking and reporting sustainability efforts.

Best Practices for Implementing Compliance Technology

1. Assess Organizational Needs

Identify specific compliance challenges and choose technology solutions that address them effectively.

2. Ensure Integration

Select tools that integrate seamlessly with existing systems and workflows.

3. Train Employees

Invest in training staff to use compliance technologies effectively and understand their benefits.

4. Monitor Performance

Regularly evaluate the effectiveness of compliance tools and update them as needed.

5. Engage Experts

Collaborate with technology providers and regulatory consultants to ensure smooth implementation and adherence to best practices.

Conclusion

Technology is not just a tool but a transformative force in regulatory compliance management. By automating processes, enhancing accuracy, and reducing costs, it empowers organizations to navigate the complexities of modern regulations efficiently. As advancements like AI, blockchain, and IoT continue to evolve, the future of compliance management promises even greater innovation and efficiency.

For organizations, embracing these technologies is no longer optional—it is essential to maintain competitiveness, protect reputation, and ensure adherence to ethical and legal standards. By staying informed and proactive, businesses can leverage technology to turn compliance challenges into opportunities for growth and improvement.

1. What is regulatory compliance management?

Regulatory compliance management involves ensuring that an organization adheres to laws, regulations, and industry standards. It includes monitoring regulations, implementing policies, conducting audits, and addressing non-compliance issues.

2. How is technology revolutionizing regulatory compliance management?

Technology is transforming compliance management by automating processes, improving accuracy, enhancing data security, providing real-time monitoring, and streamlining audits and reporting.

3. What are the key technologies used in compliance management?

Artificial Intelligence (AI) for risk prediction and document review.

Machine Learning (ML) for adaptive compliance solutions.

Blockchain for secure and transparent record-keeping.

Cloud-based platforms for scalability and remote access.

IoT devices for real-time operational monitoring.

4. What are the benefits of using technology in compliance management?

Automation reduces manual errors and inefficiencies.

Real-time monitoring enables swift corrective actions.

Enhanced data security protects sensitive information.

Lower operational costs compared to manual processes.

Improved accuracy and consistency across compliance efforts.

5. How does AI improve compliance management?

AI enhances compliance management by:

Analyzing regulations and suggesting actionable steps.

Identifying potential risks through predictive analytics.

Automating document review for inconsistencies or violations.

6. What role does blockchain play in compliance management?

Blockchain provides an immutable and secure record of transactions, ensuring transparency and traceability. It is particularly useful in industries like finance and healthcare, where regulatory requirements demand verifiable documentation.

7. How can small businesses adopt compliance technology effectively?

Small businesses can:

Start with scalable, cloud-based compliance tools.

Leverage affordable automation software for basic compliance tasks.

Train staff on using compliance technologies.

Consult experts to ensure proper implementation and adherence.

8. How does technology help with real-time compliance monitoring?

Compliance platforms integrate with business systems to monitor activities in real-time. They provide automated alerts for non-compliance risks, enabling organizations to address issues promptly and avoid penalties.

9. What challenges do organizations face when implementing compliance technology?

High initial investment costs.

Integration issues with existing systems.

Lack of expertise in using advanced tools.

Resistance to change among employees.

Keeping up with rapidly evolving technologies.

10. What is the future of compliance technology?

The future includes:

AI-powered regulation interpretation.

Predictive compliance tools to prevent risks proactively.

Greater focus on sustainability and ESG compliance.

Standardization of regulations across jurisdictions.

Enhanced collaboration through cloud-based and blockchain systems.