What is a Compliance Audit?

A compliance audit is a formal, systematic review process designed to assess whether an organization is adhering to relevant laws, regulations, policies, and industry standards. This type of audit is crucial for ensuring that an organization operates within the bounds of legal and ethical frameworks, thereby mitigating risks and maintaining operational integrity.

Purpose of a Compliance Audit

The primary purpose of a compliance audit in Delhi is to evaluate whether an organization is following external legal requirements and internal policies that impact its operations. It serves to answer the critical question: “Is this company doing what it’s supposed to be doing?” By thoroughly examining various aspects of an organization’s operations, a compliance audit helps identify any gaps or deficiencies in adherence to established rules and regulations.

Key Components of a Compliance Audit

Review of Compliance Preparations: The audit examines the organization’s readiness and processes for complying with applicable regulations and standards. This includes evaluating documentation, policies, and procedures in place to ensure compliance.

Security Policies Evaluation: The audit assesses the strength and effectiveness of security policies implemented by the organization to protect sensitive information and ensure data privacy.

Risk Management Procedures: Auditors review how well the organization identifies, manages, and mitigates risks associated with non-compliance. This includes evaluating internal controls and risk management strategies.

User Access Controls: The audit examines controls over user access to sensitive data and systems to ensure that only authorized personnel have access to critical information.

Identification of Compliance Gaps: The audit identifies any areas where the organization may be falling short of compliance requirements and provides recommendations for improvement.

Recommendations for Improvement: Based on the findings, auditors offer actionable recommendations to address any identified gaps and enhance overall compliance.

Types of Compliance Audits

Compliance audits can vary depending on the specific regulations and standards relevant to an organization. Some common types include:

Regulatory Compliance Audits: These audits focus on adherence to laws and regulations imposed by government authorities. Examples include audits for financial regulations, environmental laws, and health and safety standards.

Internal Compliance Audits: Conducted internally by an organization’s audit team, these audits assess adherence to internal policies, procedures, and codes of conduct.

External Compliance Audits: Performed by independent third-party auditors, these audits evaluate adherence to external regulatory requirements and industry standards.

ISO Compliance Audits: These audits assess adherence to international standards set by the International Organization for Standardization (ISO) for various aspects of operations, including information security and quality management.

HIPAA Audits: Specific to the healthcare industry, these audits evaluate compliance with the Health Insurance Portability and Accountability Act (HIPAA) regulations for protecting patient data.

Importance of Compliance Audits

Compliance audits are essential for several reasons:

Regulatory Adherence: Ensures that the organization complies with applicable laws and regulations, thereby avoiding legal penalties and fines.

Risk Management: Helps identify and mitigate risks associated with non-compliance, including financial, operational, and reputational risks.

Operational Efficiency: Identifies inefficiencies and redundancies in processes, allowing the organization to streamline operations and reduce costs.

Financial Accuracy: Ensures the accuracy and reliability of financial reports and statements, which are critical for decision-making and stakeholder trust.

Trust and Credibility: Demonstrates the organization’s commitment to ethical business practices, thereby building trust with stakeholders such as investors, customers, and employees.

Process of a Compliance Audit

The compliance audit in Delhi typically involves several key steps:

Planning: The audit begins with planning, which includes defining the scope of the audit, identifying relevant regulations and standards, and establishing the audit team.

Preparation: The organization prepares for the audit by gathering relevant documentation, policies, and procedures. This may also involve pre-audit assessments and self-audits.

Fieldwork: Auditors conduct the fieldwork phase, which involves examining documents, interviewing staff, and observing operations to assess compliance with regulations and standards.

Analysis: The auditors analyze the collected data to identify any areas of non-compliance and evaluate the effectiveness of existing controls and procedures.

Reporting: A comprehensive audit report is prepared, detailing the findings, identified gaps, and recommendations for improvement. The report is presented to the organization’s management and relevant stakeholders.

Follow-Up: The organization takes corrective actions based on the audit recommendations. Follow-up audits or reviews may be conducted to ensure that the recommended changes have been implemented effectively.

1. Planning and Preparation

1.1 Define Audit Scope and Objectives

Scope: Determine which regulations, standards, and internal policies will be audited. This can include specific areas such as financial reporting, data protection, or environmental compliance.

Objectives: Clearly define the objectives of the audit, including what the audit aims to achieve and the key areas of focus.

1.2 Develop an Audit Plan

Timeline: Create a detailed timeline for the audit, outlining each phase and setting deadlines for completion.

Resources: Allocate resources, including audit team members, tools, and budget.

Checklist: Develop a checklist of documents, records, and procedures that will be reviewed during the audit.

1.3 Assemble the Audit Team

Internal Team: Select members from within the organization who have the necessary knowledge and expertise.

External Auditors: If applicable, engage external auditors who can provide an independent perspective and specialized skills.

1.4 Communicate with Stakeholders

Inform relevant stakeholders, including senior management, department heads, and staff, about the upcoming audit. Outline the purpose, scope, and expectations to ensure cooperation and transparency.

2. Document Review and Preparation

2.1 Gather Relevant Documentation

Policies and Procedures: Collect documents related to internal policies, procedures, and guidelines.

Compliance Records: Obtain records related to compliance with external regulations, such as permits, licenses, and certification documents.

Previous Audit Reports: Review past audit reports and any previous findings to understand historical compliance issues.

2.2 Review Documentation

Compliance Policies: Evaluate the adequacy and effectiveness of the organization’s compliance policies and procedures.

Legal and Regulatory Requirements: Ensure that the organization’s documentation aligns with applicable laws and regulations.

3. Fieldwork

3.1 Conduct Interviews

Staff Interviews: Interview key personnel to understand their roles, responsibilities, and adherence to compliance procedures.

Management Interviews: Discuss with management to assess their awareness of compliance requirements and their commitment to adhering to them.

3.2 Perform Site Visits

On-Site Observations: Visit relevant departments or locations to observe operations and verify compliance with established policies and procedures.

3.3 Examine Records and Transactions

Data Analysis: Review financial records, operational reports, and other relevant data to assess compliance.

Transaction Testing: Test a sample of transactions to verify that they comply with internal policies and external regulations.

4. Analysis

4.1 Evaluate Findings

Compliance Gaps: Identify any areas where the organization is not meeting regulatory or policy requirements.

Risk Assessment: Assess the potential risks associated with identified non-compliance issues, including financial, operational, and reputational risks.

4.2 Determine Impact

Severity: Determine the severity of each compliance gap and its potential impact on the organization.

Root Cause Analysis: Conduct a root cause analysis to understand why non-compliance occurred and identify underlying issues.

5. Reporting

5.1 Draft the Audit Report

Findings: Summarize the audit findings, including areas of non-compliance and any issues identified.

Recommendations: Provide actionable recommendations for addressing identified compliance gaps and improving adherence to regulations and policies.

Supporting Evidence: Include supporting evidence and documentation to substantiate the findings and recommendations.

5.2 Review and Finalize the Report

Internal Review: Review the draft report internally with the audit team to ensure accuracy and completeness.

Management Review: Share the draft report with senior management for feedback and confirmation of findings.

5.3 Distribute the Report

Stakeholders: Distribute the final audit report to relevant stakeholders, including management, board members, and regulatory bodies if required.

6. Follow-Up

6.1 Implement Corrective Actions

Action Plan: Develop and implement an action plan to address the recommendations provided in the audit report.

Responsibility: Assign responsibilities for implementing corrective actions and set deadlines for completion.

6.2 Monitor Progress

Follow-Up Reviews: Conduct follow-up reviews to ensure that corrective actions have been effectively implemented.

Continuous Improvement: Evaluate the effectiveness of the corrective actions and make adjustments as needed to prevent future non-compliance issues.

6.3 Report on Progress

Status Updates: Provide periodic updates to management and stakeholders on the progress of implementing corrective actions and addressing compliance issues.

Compliance Audit Case Study Examples

Case Study 1: Tax Audit of a Multinational Corporation

Background: A multinational corporation operating in India was facing challenges in complying with the complex Indian tax laws. The company was concerned about potential penalties and legal implications due to non-compliance.

Audit Scope: The audit focused on the company’s income tax returns, transfer pricing documentation, and compliance with the Goods and Services Tax (GST) laws.

Findings: The audit revealed several areas of non-compliance, including incorrect transfer pricing adjustments, errors in GST calculations, and inadequate documentation.

Recommendations: The auditors recommended the following measures:

Transfer Pricing Optimization: Re-evaluate the company’s transfer pricing arrangements to ensure compliance with Indian transfer pricing regulations.

GST Compliance Enhancement: Implement a robust GST compliance system, including regular training for employees and timely filing of returns.

Documentation Improvement: Maintain detailed documentation for all transactions to support tax claims and reduce the risk of audits.

Case Study 2: Environmental Audit of a Manufacturing Plant

Background: A manufacturing plant located in a pollution-prone region of India was facing allegations of environmental violations. The company was under pressure from local communities and regulatory authorities.

Audit Scope: The audit assessed the plant’s compliance with environmental laws, including the Environment Protection Act, 1986, and the National Green Tribunal Act, 2010.

Findings: The audit identified several environmental violations, such as improper waste disposal, excessive air emissions, and non-compliance with pollution control standards.

Recommendations:

The auditors recommended the following measures:

Waste Management Improvement: Implement a comprehensive waste management plan, including proper segregation, treatment, and disposal of hazardous waste.

Pollution Control Measures: Install advanced pollution control equipment to reduce emissions and comply with environmental standards.

Environmental Impact Assessment: Conduct a regular environmental impact assessment to identify potential risks and take preventive measures.

Case Study 3: Internal Audit of a Public Sector Undertaking

Recommendations:

The auditors recommended the following measures:

Improved Procurement Practices: Adopt transparent and competitive procurement procedures.

Enhanced Governance: Establish a strong governance framework, including independent oversight and regular audits.

Case Study 4: Labor Audit of a Textile Factory

Background: A textile factory in India was facing allegations of child labor and poor working conditions. The company was under scrutiny from international buyers and human rights organizations.

Audit Scope: The audit assessed the factory’s compliance with labor laws, including the Child Labor Prohibition Act, 1986, and the Factories Act, 1948.

Findings: The audit identified instances of child labor, forced labor, and unsafe working conditions.

Recommendations:

The auditors recommended the following measures

Elimination of Child Labor: Implement measures to identify and remove child laborers from the factory.

Improvement of Working Conditions: Ensure safe and healthy working conditions, including adequate ventilation, lighting, and sanitation facilities.

Compliance with Labor Laws: Adhere to all applicable labor laws and regulations, including minimum wage requirements and working hours.

Case Study 5: Food Safety Audit of a Food Processing Plant

Background: A food processing plant in India was facing allegations of food contamination and product recalls. The company’s reputation was at stake.

Audit Scope: The audit assessed the plant’s compliance with food safety standards, as per the Food Safety and Standards Act, 2006, and its regulations.

Findings: The audit identified several food safety hazards, including improper hygiene practices, inadequate sanitation facilities, and non-compliance with traceability requirements.

Recommendations:

The auditors recommended the following measures:

Improved Hygiene Practices: Implement strict hygiene practices throughout the production process.

Enhanced Sanitation Facilities: Ensure adequate sanitation facilities, including clean water, toilets, and handwashing stations.

Strengthened Traceability System: Establish a robust traceability system to track products from farm to fork.

Case Study 6: Information Technology Audit of a Financial Institution

Background: A financial institution in India was concerned about data breaches and cyberattacks. The company wanted to protect its customers’ sensitive information.

Audit Scope: The audit assessed the institution’s compliance with information technology security standards, including the Payment Card Industry Data Security Standard (PCI DSS) and the Information Technology Act, 2000.

Findings: The audit identified several vulnerabilities in the institution’s IT infrastructure, including weak passwords, inadequate network security, and lack of data encryption.

Recommendations:

The auditors recommended the following measures:

Enhanced Network Security: Implement robust network security measures, including firewalls, intrusion detection systems, and vulnerability scanning.

Data Encryption: Encrypt sensitive customer data to protect it from unauthorized access.

Employee Awareness Training: Conduct regular employee awareness training on cybersecurity best practices.

Compliance Audit Guidelines

1. Understand the Scope and Objectives

Guideline: Clearly define the scope and objectives of the audit based on the specific regulations, standards, or internal policies being reviewed.

Identify Regulatory Requirements: Understand the specific regulations or standards relevant to the organization’s industry, such as GDPR for data protection or SOX for financial reporting.

Define Audit Scope: Determine which areas, departments, or processes will be included in the audit.

Set Objectives: Establish clear objectives for the audit, such as assessing compliance with specific regulations or improving internal controls.

2. Develop a Detailed Audit Plan

Guideline: Create a comprehensive audit plan outlining the audit’s scope, methodology, timeline, and resources required.

Audit Scope and Criteria: Document the scope, including the specific regulations or standards to be reviewed, and the criteria for evaluation.

Audit Methodology: Describe the methods and procedures to be used during the audit, such as document reviews, interviews, and testing.

Timeline and Resources: Develop a timeline for the audit and allocate resources, including personnel and tools needed for the audit.

3. Gather and Review Relevant Documentation

Guideline: Collect and review documentation relevant to the compliance requirements being audited.

Documentation Collection: Gather relevant documents, such as policies, procedures, financial records, and contracts.

Document Review: Examine the documents to assess their alignment with regulatory requirements and internal policies.

Identify Gaps: Note any discrepancies or gaps in documentation that may indicate non-compliance.

4. Conduct Fieldwork and Testing

Guideline: Perform on-site fieldwork and testing to evaluate compliance with regulations and internal controls.

Fieldwork Procedures: Conduct interviews with key personnel, observe processes, and perform walkthroughs to understand how compliance is managed.

Testing: Test internal controls, security measures, and other relevant procedures to ensure they meet compliance requirements.

Document Findings: Record findings from fieldwork and testing, noting any issues or areas of concern.

5. Analyze Findings and Assess Compliance

Guideline: Analyze the audit findings to assess the organization’s compliance with the relevant regulations and standards.

Evaluate Compliance: Compare findings against regulatory requirements and internal policies to determine compliance status.

Identify Non-Compliance: Highlight any areas where the organization is not meeting compliance requirements or where improvements are needed.

Assess Impact: Evaluate the potential impact of non-compliance on the organization, including legal, financial, and operational risks.

6. Prepare and Present Audit Report

Guideline: Prepare a detailed audit report summarizing the findings, conclusions, and recommendations for addressing any compliance issues.

Report Structure: Include sections such as an executive summary, audit objectives, methodology, findings, and recommendations.

Findings and Recommendations: Clearly present the audit findings, including any instances of non-compliance, and provide actionable recommendations for improvement.

Presentation: Communicate the audit report to relevant stakeholders, including management and the board of directors, ensuring clarity and transparency.

7. Follow-Up and Monitor Implementation

Guideline: Monitor the implementation of recommendations and follow up on any corrective actions taken in response to the audit findings.

Action Plan: Develop an action plan with timelines for implementing recommendations and addressing identified issues.

Follow-Up: Regularly follow up with the organization to ensure that corrective actions are being implemented effectively.

Continuous Improvement: Encourage ongoing improvements to compliance processes and controls based on audit findings and feedback.

8. Stay Informed About Regulatory Changes

Guideline: Keep up-to-date with changes in regulations and industry standards that may impact compliance requirements.

Regulatory Updates: Subscribe to newsletters, attend industry conferences, and follow regulatory bodies to stay informed about changes in regulations.

Update Compliance Practices: Adjust internal policies and procedures to reflect any new or revised regulations.

9. Train and Educate Personnel

Guideline: Ensure that employees are trained and educated about compliance requirements and their roles in maintaining compliance.

Training Programs: Develop and implement training programs on compliance policies, procedures, and best practices.

Ongoing Education: Provide ongoing education and resources to keep employees informed about changes in compliance requirements.

10. Document and Maintain Records

Guideline: Maintain comprehensive records of the audit process, findings, and follow-up actions.Audit Documentation: Keep detailed records of audit planning, fieldwork, findings, and communications.Record Retention: Ensure that records are retained for the required period, in accordance with legal and regulatory requirements.

Types of Compliance Audits

Compliance audits are essential for ensuring that organizations adhere to legal, regulatory, and internal standards. Various types of compliance audits focus on different aspects of regulatory and organizational requirements. Here’s an overview of the main types:

**1. ISO Compliance Audit

Focus:

Standards: Information security management, quality management, environmental management, and more.

Objective: Ensure that the organization adheres to international standards set by the International Organization for Standardization (ISO).

Types:

ISO 9001: Quality management systems.

ISO 27001: Information security management.

ISO 14001: Environmental management.

Difference:

ISO Certification: Involves formal certification by an external body.

ISO Compliance Audit: Focuses on adherence to standards without necessarily seeking certification.

**2. Office of Federal Contract Compliance Programs (OFCCP) Audit

Focus:

Affirmative Action: Compliance with affirmative action and equal employment opportunity requirements for federal contractors.

Objective: Ensure that federal contractors are providing equal employment opportunities and implementing affirmative action plans.

**3. National Institute of Standards and Technology (NIST) Compliance Audit

Focus:

Standards: Measurement standards and technology for various industries, including cybersecurity frameworks.

Objective: Assess compliance with NIST standards and guidelines, such as the NIST Cybersecurity Framework.

Notable Standards:

NIST SP 800-53: Security and privacy controls for federal information systems.

NIST SP 800-171: Protecting controlled unclassified information in non-federal systems.

**4. HIPAA (Health Insurance Portability and Accountability Act) Audit

Focus:

Health Information Protection: Compliance with privacy and security rules related to medical information.

Objective: Ensure that healthcare providers, insurers, and their business associates protect patient health information according to HIPAA regulations.

Key Areas:

Privacy Rule: Protects individual health information.

Security Rule: Safeguards electronic health information.

**5. Sarbanes-Oxley Act (SOX) Audit

Focus:

Financial Reporting: Compliance with regulations governing financial practices and corporate governance.

Objective: Ensure that public companies maintain accurate financial records and effective internal controls.

Key Provisions:

Section 404: Requires management to assess and report on internal controls over financial reporting.

Section 302: Mandates certification of financial reports by senior executives.

**6. PCI-DSS (Payment Card Industry Data Security Standard) Audit

Focus:

Payment Data Security: Compliance with standards for securing cardholder information.

Objective: Ensure that organizations handling payment card data protect it from breaches and fraud.

Key Requirements:

Network Security: Implementing strong access control measures and maintaining a secure network.

Data Protection: Encrypting cardholder data and maintaining a vulnerability management program.

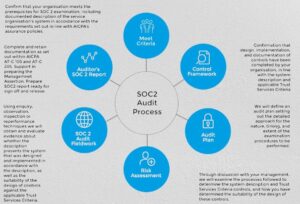

**7. SOC 2 (Systems and Organizational Controls) Audit

Focus:

Service Providers: Compliance with standards related to security, availability, processing integrity, confidentiality, and privacy.

Objective: Assess controls in place to protect customer data for service providers handling sensitive information in the cloud.

Trust Service Criteria:

Security: Protection of system against unauthorized access.

Availability: Accessibility of the system as agreed upon.

Processing Integrity: Accuracy, completeness, and timeliness of system processing.

8. Statement on Standards for Attestation Engagements No. 16 (SSAE-16) Audit

Focus:

Service Organizations: Controls affecting clients’ financial reporting.

Objective: Evaluate controls at service organizations that impact their clients’ financial statements.

Types:

Type I: Describes the service organization’s system and the suitability of the design of controls.

Type II: Includes the Type I description and tests the operating effectiveness of the controls.

9. GDPR (General Data Protection Regulation) Audit

Focus:

Data Privacy: Compliance with data protection regulations for organizations processing data of EU citizens.

Objective: Ensure that organizations adhere to GDPR requirements for handling personal data.

Key Principles:

Data Minimization: Collecting only the data necessary for the intended purpose.

Data Subject Rights: Ensuring individuals can exercise their rights under GDPR, such as access and deletion of their data.

10. California Consumer Privacy Act (CCPA) Audit

Focus:

Data Privacy: Compliance with privacy regulations specific to California residents.

Objective: Ensure that businesses comply with CCPA requirements regarding the collection, use, and sharing of personal information.

Key Provisions:

Consumer Rights: Providing rights to access, delete, and opt-out of the sale of personal data.

Business Obligations: Implementing measures for data protection and transparency.

Compliance Audit Services in Delhi

ACATL is a leading Regulatory Compliance Audit Service in Delhi, specializing in comprehensive solutions for regulatory compliance and risk management. Their services ensure that businesses adhere to legal requirements while optimizing operational efficiency and minimizing risks.

1. Regulatory Compliance Audits

Description: These audits assess an organization’s adherence to laws and regulations specific to various industries. They cover areas such as tax laws, labor laws, environmental regulations, and industry-specific standards.

Examples:

Tax Compliance Audits: Ensure adherence to income tax, GST, and other tax regulations.

Labor Law Compliance: Verify adherence to labor laws, including minimum wages, employee benefits, and working conditions.

Environmental Compliance: Assess compliance with environmental regulations, including waste management and pollution control.

2. Internal Audits

Description: Internal audits focus on evaluating an organization’s internal controls, processes, and risk management practices. They help improve operational efficiency and ensure that internal procedures align with regulatory requirements.

Examples:

Financial Audits: Review financial statements, internal controls, and financial reporting processes.

Operational Audits: Assess the efficiency and effectiveness of operational processes and procedures.

Compliance Audits: Ensure internal procedures are in line with legal and regulatory requirements.

3. Sector-Specific Compliance Audits

Description: These audits are tailored to specific industries and their unique regulatory requirements. They help ensure that businesses meet sector-specific compliance standards.

Examples:

Healthcare Compliance Audits: Ensure adherence to regulations such as HIPAA for patient data protection.

Financial Services Compliance: Verify compliance with financial regulations such as the Securities and Exchange Board of India (SEBI) guidelines.

Manufacturing Compliance: Assess adherence to quality standards and environmental regulations.

4. Data Privacy and Security Audits

Description: These audits focus on compliance with data protection regulations and security standards. They assess how organizations handle and protect sensitive data.

Examples:

GDPR Compliance Audits: Ensure compliance with the General Data Protection Regulation (GDPR) for businesses handling EU residents’ data.

ISO 27001 Audits: Assess adherence to information security management standards.

5. Health and Safety Compliance Audits

Description: These audits ensure that organizations comply with health and safety regulations, providing a safe working environment for employees.

Examples:

Occupational Safety and Health Administration (OSHA) Compliance: Evaluate adherence to workplace safety regulations.

Health and Safety Management Systems Audits: Assess compliance with health and safety management systems standards.

6. Tax Compliance and Reporting Audits

Description: These audits focus on ensuring that businesses comply with tax laws and reporting requirements, including accurate tax filings and adherence to tax regulations.

Examples:

Indirect Tax Audits: Review compliance with Goods and Services Tax (GST) and other indirect taxes.

Direct Tax Audits: Ensure adherence to income tax laws and regulations.

FAQs on Compliance Audit

1. What is a compliance audit?

A compliance audit is an examination of an organization’s adherence to external regulations, laws, standards, or internal policies. The goal is to ensure that the organization complies with all relevant requirements and operates within the established legal and regulatory frameworks.

2. Why are compliance audits important?

Compliance audits are crucial for identifying and addressing compliance issues, avoiding legal penalties, ensuring adherence to standards, and maintaining an organization’s reputation. They help businesses stay aligned with regulatory requirements and prevent potential legal and financial repercussions.

3. Who conducts a compliance audit?

Compliance audits are typically conducted by external auditors, specialized compliance consultants, or internal audit teams within the organization. External audits are often performed by independent firms to provide an impartial review, while internal audits are conducted by the organization’s own audit staff.

4. How often should compliance audits be conducted?

The frequency of compliance audits depends on industry regulations, company policies, and specific risks. Common practices include annual or biannual audits, but some organizations may require more frequent audits based on their risk profile and regulatory requirements.

5. What are the typical steps in a compliance audit?

The typical steps include:

Planning: Define the scope and objectives of the audit.

Preparation: Gather necessary documentation and information.

Execution: Review processes, interview staff, and test controls.

Analysis: Evaluate findings against regulatory requirements.

Reporting: Document findings, provide recommendations, and discuss results with relevant stakeholders.

6. What documents are required for a compliance audit?

Required documents often include regulatory filings, internal policies and procedures, financial statements, contracts, and records of compliance activities. These documents provide the basis for assessing whether the organization meets the necessary requirements.

7. What happens if non-compliance issues are found during an audit?

If non-compliance issues are identified, the audit report will detail these findings. The organization must then develop and implement a corrective action plan to address the issues. Follow-up reviews may be conducted to ensure that corrective actions are effectively implemented.

8. How should an organization prepare for a compliance audit?

Preparation involves:

Reviewing and updating compliance policies and procedures.

Organizing necessary documentation.

Training staff on audit processes and compliance requirements.

Conducting internal checks to ensure adherence to regulations.

9. Can compliance audit results be challenged?

Yes, organizations can challenge audit results by providing additional evidence, clarifying misunderstandings, or discussing findings with the auditors. It is essential to address any discrepancies or concerns in a constructive manner.

10. What are the benefits of a compliance audit?

Benefits include enhanced regulatory compliance, improved internal controls, risk mitigation, increased confidence among stakeholders, and prevention of legal and financial penalties. Compliance audits also help organizations streamline their operations and maintain a positive reputation.

11. What challenges might organizations face during a compliance audit?

Challenges can include the complexity of regulations, resource constraints, potential disruptions to operations, and the need for comprehensive documentation. Organizations may also face difficulties in interpreting regulatory requirements and implementing necessary changes.

12. How are compliance audit results communicated?

Audit results are typically communicated through a detailed audit report that includes findings, recommendations, and an action plan. The report is shared with relevant stakeholders, such as management and the board of directors, to facilitate informed decision-making.

13. What is the role of management after an audit?

Management is responsible for reviewing the audit report, addressing findings, implementing corrective actions, and ensuring ongoing compliance. They must also track the effectiveness of the corrective measures and make necessary adjustments to maintain compliance.