Unlocking the Power of Payroll Services in Delhi: A Comprehensive Guide for Businesses

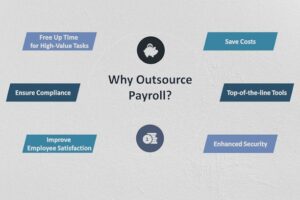

Managing payroll is a critical aspect of running a business, but it can also be one of the most time-consuming and complex tasks, especially for businesses in a bustling city like Delhi. Ensuring that your employees are paid accurately and on time while maintaining compliance with tax regulations and labor laws requires significant attention to detail. This is where payroll services in Delhi come into play. Outsourcing payroll to a trusted provider can free up valuable resources, reduce administrative burdens, and ensure smooth business operations.

In this blog, we will explore the benefits of payroll services, the challenges businesses face when managing payroll in-house, and why outsourcing payroll services in Delhi is a smart move for businesses of all sizes.

The Growing Need for Payroll Services in Delhi

As one of India’s largest business hubs, Delhi is home to a diverse range of industries, from startups to large enterprises. Each of these businesses has its own unique payroll challenges, whether it’s managing complex salary structures, handling statutory compliance, or accommodating flexible work arrangements.

Many small and medium-sized enterprises (SMEs) in Delhi lack the dedicated resources needed to handle payroll effectively. Payroll management involves not just salary disbursement, but also calculating taxes, managing employee benefits, and ensuring compliance with local and national labor laws. For these reasons, businesses are increasingly turning to payroll outsourcing services in Delhi to simplify operations and reduce errors.

Key Benefits of Payroll Outsourcing in Delhi

Outsourcing payroll services to a professional provider in Delhi can offer a range of benefits that go beyond simple convenience. Let’s take a closer look at how payroll outsourcing can help your business.

1. Accuracy and Timeliness

Payroll accuracy is critical for employee satisfaction and for avoiding legal issues. Errors in payroll calculations or late payments can lead to dissatisfied employees and, in extreme cases, legal penalties. Outsourcing payroll ensures that salary disbursements are accurate and on time, every time.

2. Compliance with Local Regulations

Delhi businesses need to comply with numerous local, state, and national labor laws and tax regulations. Payroll service providers in Delhi specialize in understanding these regulations, ensuring that your business complies with tax filing deadlines, labor laws, and statutory requirements. This minimizes the risk of non-compliance and potential penalties.

3. Cost-Effectiveness

Managing payroll in-house can be costly, particularly for small businesses. It often involves hiring dedicated staff, purchasing software, and spending time on manual processes. Outsourcing payroll reduces these costs by offering a more affordable solution, where you only pay for the services you need.

4. Data Security

Payroll involves handling sensitive employee information, such as bank details, salary information, and tax records. Payroll service providers use secure platforms and technology to protect this data from breaches or unauthorized access. This ensures that employee information is handled confidentially and securely.

5. Scalability

As your business grows, so do your payroll requirements. Payroll outsourcing services in Delhi offer scalability, allowing you to easily add new employees to the system and adjust services as your business expands. This flexibility ensures that your payroll system grows with your business without additional administrative burdens.

6. Improved Focus on Core Business Activities

By outsourcing payroll, you can focus on your core business activities, such as product development, sales, and customer service, without the distraction of managing payroll processes. Payroll outsourcing frees up valuable time for business owners and HR teams, allowing them to contribute more to strategic growth.

Common Payroll Challenges Faced by Delhi Businesses

While outsourcing payroll offers numerous advantages, many businesses continue to manage payroll internally. However, this often leads to challenges, such as:

Inconsistent Payroll Processing: Manual payroll processing can lead to inconsistencies, especially when salary calculations, deductions, and tax withholdings vary by employee.

Tax Calculation Errors: Tax regulations are constantly changing, and businesses must stay updated to avoid miscalculations and penalties.

Data Management Issues: Keeping employee records up to date, especially for a growing workforce, can be cumbersome and lead to errors in payroll calculations and compliance reporting.

Time-Consuming Processes: In-house payroll management is time-intensive and often requires manual work, leading to inefficiencies and delays.

Why Choose ACATL’s Payroll Services in Delhi?

At ACATL, we understand the complexities that come with managing payroll. Our payroll services in Delhi are designed to help businesses of all sizes simplify their payroll processes, ensure compliance, and maintain accurate payroll records. Here’s what sets us apart:

1. Comprehensive Payroll Management

Our payroll services cover everything from calculating salaries and bonuses to managing deductions, tax filings, and statutory compliances. We ensure that your payroll is processed accurately and efficiently, minimizing the risk of errors.

2. Tailored Solutions

We offer customizable payroll services that can be tailored to meet the unique needs of your business. Whether you’re a small startup or a large enterprise, we have solutions that fit your budget and payroll requirements.

3. Statutory Compliance Support

Our team stays updated on the latest changes in tax laws, labor regulations, and statutory requirements. We handle all compliance-related tasks, including tax filings, EPF/ESI contributions, and professional tax deductions, ensuring that your business meets its legal obligations.

4. Advanced Payroll Software

We use advanced payroll software that automates processes, reduces manual work, and ensures accurate payroll calculations. Our technology-driven approach guarantees timely disbursements and eliminates the risk of human errors.

5. End-to-End Payroll Solutions

From onboarding new employees to processing final settlements, we offer end-to-end payroll management. We handle all aspects of payroll, so you can focus on running your business while we take care of your payroll needs.

How ACATL’s Payroll Services Can Benefit Your Business

Whether you’re a startup or an established business, partnering with a professional payroll service provider in Delhi like ACATL can significantly improve your payroll operations. Our expertise and technology-driven approach ensure that your payroll is managed efficiently, leaving you more time and resources to focus on your business goals.

Frequently Asked Questions (FAQs)

1. What are payroll services?

Payroll services involve the management of employee salaries, tax calculations, compliance with legal regulations, and disbursement of salaries.

2. Why should businesses in Delhi outsource payroll?

Outsourcing payroll helps businesses reduce errors, stay compliant with regulations, save time, and cut costs by eliminating the need for an internal payroll team.

3. How do payroll services ensure compliance with tax regulations?

Payroll service providers stay updated on tax laws and statutory requirements, ensuring accurate calculations for tax filings and deductions.

4. What are the benefits of using payroll software?

Payroll software automates processes, improves accuracy, reduces manual errors, and ensures timely disbursements of salaries.

5. How much do payroll services cost in Delhi?

The cost of payroll services varies depending on the size of your business and the specific services required. ACATL offers customizable payroll packages to suit different business needs.

6. Can payroll services help with employee benefits management?

Yes, payroll service providers can assist with managing employee benefits such as health insurance, EPF, and ESI contributions.

7. What data is required for payroll processing?

Employee information, salary details, tax identification numbers, and records of bonuses, deductions, and benefits are typically required for payroll processing.

8. How often should payroll be processed?

Payroll is generally processed on a monthly basis, but this can vary depending on the business’s pay cycle (weekly, bi-weekly, monthly).

9. Can payroll services manage bonuses and incentives?

Yes, payroll services can manage bonuses, incentives, and other employee rewards, ensuring accurate disbursements.

10. How secure is the data managed by payroll services?

Payroll service providers use secure technology to ensure that sensitive employee information is protected from unauthorized access or data breaches.

For more information on how ACATL’s payroll services in Delhi can help streamline your payroll processes, contact us today and let us take the burden of payroll management off your shoulders!