Payroll Software's for Small Businesses: What you need to know before choosing the Best Solution

Managing payroll is one of the most critical functions in any business. For small businesses, it can be particularly challenging due to limited resources and manpower. Ensuring timely and accurate payroll processing is essential for keeping employees satisfied, complying with regulatory standards, and maintaining overall financial stability. Fortunately, payroll software can greatly simplify this process. However, with many options on the market, selecting the right payroll software for your small business in Delhi can be overwhelming.

In this article, we will explore the essential factors that small business owners need to consider when choosing payroll software. From understanding the key features of payroll systems to navigating compliance requirements and finding cost-effective solutions, we’ll guide you through everything you need to know before making your decision.

Why Payroll Software Is Important for Small Businesses

Before diving into the details of selecting the right payroll software, it’s important to understand why small businesses need this technology. Payroll software offers several advantages:

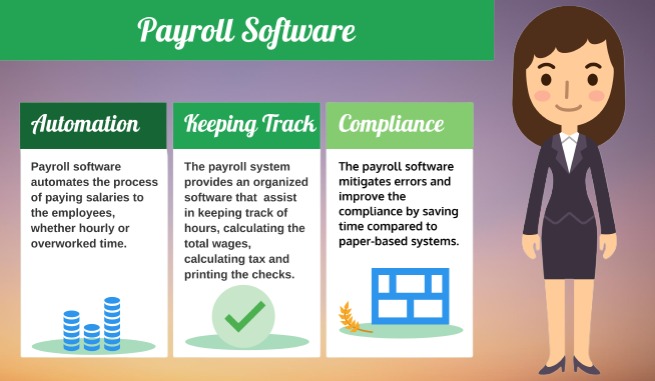

Time and Cost Savings: Traditional manual payroll processing is labor-intensive and prone to errors. Payroll software automates tasks like salary calculations, tax deductions, and payslip generation, saving time and reducing costs associated with payroll management.

Accuracy: Even small mistakes in payroll processing can lead to significant issues, including employee dissatisfaction, regulatory penalties, and financial losses. Payroll software minimizes human error, ensuring that employees are paid accurately and on time.

Compliance: Navigating the complex landscape of tax regulations and labor laws can be difficult, especially for small businesses. Payroll software is designed to handle statutory compliance, automatically calculating tax liabilities and ensuring that your business adheres to legal requirements.

Scalability: As your business grows, your payroll needs will evolve. Payroll software allows you to manage an increasing number of employees with minimal additional effort, making it easy to scale your payroll operations as your business expands.

Record Keeping and Reporting: Payroll software stores employee data, payment records, and tax documentation in a centralized system. This makes it easier to generate reports for audits, tax filings, and other business needs.

Now that we’ve established the importance of payroll software, let’s delve into the key factors to consider when selecting the right solution for your small business.

Key Features to Look for in Payroll Software

When evaluating payroll software options, there are several critical features you should prioritize. These features ensure that the system will meet the needs of your small business, streamline payroll operations, and maintain compliance with legal requirements.

Automated Payroll Calculations

One of the primary reasons to invest in payroll software is to automate the process of calculating wages, deductions, and taxes. The software should be able to automatically calculate gross pay based on hours worked, as well as handle deductions for taxes, social security, benefits, and other withholdings.

Look for payroll software that can:

Calculate hourly wages and salaries.

Manage overtime pay, bonuses, and commissions.

Calculate statutory deductions, including taxes, Employee Provident Fund (EPF), and Employee State Insurance (ESI) in India.

Generate accurate net pay amounts after deductions.

Compliance with Local Regulations

Payroll compliance is one of the most critical aspects of payroll processing. Non-compliance with local labor laws and tax regulations can result in fines, legal issues, and damage to your company’s reputation. Therefore, the payroll software you choose should have built-in compliance features that ensure your business adheres to local, state, and national regulations.

In India, this includes:

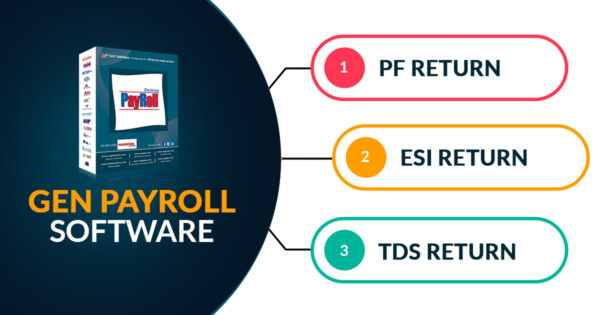

Provident Fund (PF): The software should automatically calculate contributions to the Employee Provident Fund (EPF), as mandated by Indian law.

Employee State Insurance (ESI): For eligible employees, the software should calculate contributions to the Employee State Insurance scheme.

Income Tax: The software must calculate withholding tax based on employee salaries, exemptions, and deductions under Indian tax laws.

TDS (Tax Deducted at Source): TDS should be automatically calculated and deducted based on employee salaries.

Statutory Returns: Payroll software should facilitate the filing of statutory returns, such as EPF, ESI, and TDS, helping businesses remain compliant with regulatory requirements.

User-Friendly Interface

Small business owners and their HR staff often lack extensive training in payroll management. Therefore, it’s crucial that the payroll software you choose is user-friendly and easy to navigate. Look for software with intuitive dashboards, clear workflows, and helpful guidance tools that make payroll processing as straightforward as possible.

Some features that contribute to ease of use include:

Simple Setup: The initial setup process should be straightforward, with easy options to enter employee details, salaries, and payroll schedules.

Automated Updates: The software should automatically update to reflect changes in tax laws and regulations, ensuring that your payroll processes remain compliant.

Mobile Access: Many small business owners operate on the go. Payroll software with mobile accessibility allows you to manage payroll anytime, anywhere.

Employee Self-Service Portals

An employee self-service portal is a valuable feature that empowers your employees to access their payroll information, payslips, and tax details. By giving employees direct access to their data, you can reduce the administrative burden on your HR team and improve employee satisfaction.

Key features of an employee self-service portal include:

Payslip Access: Employees should be able to view and download their payslips for each payroll cycle.

Tax Information: The portal should provide details on tax deductions, TDS, and other statutory contributions.

Leave and Attendance: Some payroll software also integrates leave management, allowing employees to track their leave balances and attendance records.

Integration with Accounting Software

For small businesses, integrating payroll with accounting is essential for maintaining accurate financial records. Payroll software that integrates with your existing accounting software simplifies the transfer of payroll data, making it easier to track expenses, manage budgets, and file tax returns.

Common accounting software integrations include:

QuickBooks: One of the most popular accounting solutions, QuickBooks integrates easily with many payroll software systems, enabling seamless financial reporting.

Zoho Books: Zoho’s suite of business tools includes accounting software that integrates well with payroll systems.

Tally: Tally is widely used in India for accounting and financial management, and many payroll software options offer compatibility with Tally for streamlined data transfers.

Scalability and Flexibility

Your small business may not stay small forever, and your payroll software should be able to grow with you. Whether you plan to hire more employees, expand into new markets, or add additional payroll features, scalability is key.

Look for software that offers:

Flexible Employee Count: The ability to add or remove employees as needed without significant changes in pricing or functionality.

Multiple Pay Schedules: The option to set up different payroll schedules (weekly, bi-weekly, monthly) based on the needs of different employee groups.

Customizable Deductions: The ability to configure custom deductions and benefits for employees, such as retirement savings plans, health insurance, or performance bonuses.

Security and Data Privacy

Given the sensitive nature of payroll data, security is of utmost importance when choosing payroll software. The system you select should have robust security features to protect employee information, salary details, and tax data from unauthorized access and cyberattacks

Key security features to look for include:

Encryption: Data should be encrypted both in transit and at rest to ensure that employee information is protected.

User Access Controls: The software should allow you to set user roles and permissions, ensuring that only authorized personnel have access to payroll data.

Data Backup: Regular data backups ensure that payroll information is protected in the event of a system failure or cyberattack.

Cost Considerations for Payroll Software

For small businesses, cost is a major factor when choosing payroll software. The price of payroll software can vary based on factors such as the number of employees, the complexity of payroll processes, and the range of features offered.

When evaluating payroll software pricing, consider the following:

Subscription-Based Pricing

Many payroll software providers offer subscription-based pricing models, which charge businesses a monthly or annual fee based on the number of employees or the features included in the package. Subscription-based pricing is ideal for small businesses because it allows for flexibility—businesses can scale their plans as they grow without incurring large upfront costs.

Pay-As-You-Go Pricing

Some payroll software providers offer pay-as-you-go pricing, where businesses are only charged for the payroll runs they process. This can be a cost-effective option for businesses with irregular payroll schedules or seasonal employees.

Free and Low-Cost Options

For startups and micro-businesses, there are free or low-cost payroll software options available. While these solutions may offer basic payroll processing and compliance features, they may lack advanced functionality such as integrations, automation, or employee self-service portals. Free payroll software can be a good starting point for small businesses but may need to be upgraded as the company grows.

Choosing the Best Payroll Software for Your Small Business

With so many payroll software options available, it’s important to take a systematic approach to finding the best solution for your business. Here are some tips to help you make the right choice:

Assess Your Business Needs

Start by evaluating your current payroll processes and identifying pain points. Are you spending too much time on manual payroll tasks? Are you struggling with compliance? Do you need a system that integrates with your accounting software? By understanding your specific needs, you can narrow down your options and focus on software that addresses your challenges.

Research Different Software Options

Take the time to research various payroll software solutions and compare their features, pricing, and user reviews. Many providers offer free trials, which can give you a hands-on experience with the software before committing to a purchase.

Consider Customer Support

Customer support is an essential consideration when selecting payroll software, especially if you’re new to payroll management. Look for providers that offer comprehensive customer support, including live chat, phone support, and online resources such as tutorials and FAQs.

Check for Compliance Features

Ensure that the payroll software you choose complies with all local regulations and tax laws. In India, this includes compliance with Provident Fund, Employee State Insurance, and income tax regulations.

Evaluate Total Cost of Ownership

Consider both the upfront and ongoing costs of the payroll software. While subscription-based models may seem affordable, additional costs for premium features, support, or integrations can add up. Be sure to evaluate the total cost of ownership over time to ensure the software fits within your budget.

Conclusion

Payroll software is an indispensable tool for small businesses, streamlining payroll operations and ensuring compliance with tax and labor laws. By choosing the right payroll software, businesses can save time, reduce errors, and improve overall efficiency. When selecting payroll software for your small business in Delhi, prioritize features such as automation, compliance, scalability, and ease of use.

At ACATL India, we specialize in helping small businesses with best Indian payroll software to navigate the complexities of payroll and compliance. We work closely with our clients to identify the best payroll solutions for their needs, ensuring that they stay compliant while optimizing their payroll processes for growth.

1. What is payroll software, and why is it important for small businesses?

Payroll software automates the process of calculating employee wages, tax deductions, and generating payslips. It’s important for small businesses because it saves time, ensures accuracy, and helps with compliance, allowing small business owners to focus on growth and operations.

2. What key features should small businesses look for in payroll software?

Small businesses should prioritize features like automated payroll calculations, compliance with local regulations, user-friendly interfaces, employee self-service portals, integration with accounting software, and scalability.

3. How does payroll software help with compliance?

Payroll software helps businesses comply with tax and labor laws by automating the calculation of statutory deductions, such as income tax, Employee Provident Fund (EPF), Employee State Insurance (ESI), and facilitating the filing of statutory returns.

4. Can payroll software integrate with accounting software?

Yes, many payroll software solutions integrate with popular accounting software like QuickBooks, Zoho Books, and Tally. This helps small businesses maintain accurate financial records and simplifies tax filings and budget management.

5. What are the benefits of an employee self-service portal in payroll software?

An employee self-service portal allows employees to access their payroll information, view and download payslips, track tax deductions, and manage leave and attendance records, reducing the administrative burden on HR staff.

6. How does payroll software ensure data security?

Payroll software ensures data security through encryption, user access controls, and regular data backups. These features protect sensitive payroll information from unauthorized access and cyberattacks.

7. What are the pricing models for payroll software?

Common pricing models for payroll software include subscription-based pricing (monthly or annual fees), pay-as-you-go pricing (pay per payroll run), and free or low-cost options for startups or micro-businesses. Pricing depends on the number of employees and features needed.

8. Is payroll software scalable for growing small businesses?

Yes, many payroll software solutions are scalable, allowing businesses to add more employees, set up multiple pay schedules, and configure custom deductions as their business grows.

9. How can small businesses choose the right payroll software?

Small businesses should assess their payroll needs, research different software options, consider features like compliance and integrations, evaluate the total cost of ownership, and look for solutions that offer reliable customer support.

10. What are the compliance requirements payroll software should address in India?

In India, payroll software should handle compliance with Provident Fund (PF), Employee State Insurance (ESI), income tax, and Tax Deducted at Source (TDS), automatically calculating and deducting these amounts as required by law