Top Tips for Efficient and Error-Free Payroll Processing

Automate Payroll Systems:

Implement payroll software to automate calculations, deductions, and tax withholdings. Automation reduces manual errors, speeds up processing, and ensures consistency.

Regularly Update Employee Information:

Keep employee records current with accurate personal details, tax information, and payment preferences. Regular updates help avoid errors in payroll calculations and tax reporting.

Ensure Compliance with Laws and Regulations:

Stay informed about federal, state, and local payroll laws, including tax rates, minimum wage, and labor regulations. Compliance prevents costly fines and legal issues.

Conduct Regular Audits:

Perform periodic audits of payroll processes and records to identify and correct discrepancies. Regular reviews help ensure accuracy and compliance.

Implement a Clear Payroll Process:

Establish and document a standardized payroll process, including deadlines, approval workflows, and data entry procedures. Clear guidelines improve efficiency and reduce errors.

Provide Ongoing Training:

Train payroll staff on software updates, regulatory changes, and best practices. Ongoing education ensures that the team remains knowledgeable and capable.

Use Secure Data Handling Practices:

Protect sensitive payroll information with encryption and secure access controls. Safeguarding data prevents breaches and maintains confidentiality.

Double-Check Data Entries:

Implement checks and balances for data entry. Have multiple people review payroll data before finalizing to catch any errors or discrepancies.

Maintain Accurate Timekeeping Records:

Use reliable timekeeping systems to track employee hours and attendance. Accurate time records are essential for calculating wages and managing overtime.

Stay Up-to-Date with Tax Filing Requirements:

Ensure timely and accurate submission of payroll taxes and filings. Stay informed about deadlines and changes in tax laws to avoid penalties.

Regularly Backup Payroll Data:

Schedule regular backups of payroll data to prevent loss in case of system failures or other emergencies. Ensure backups are securely stored and easily retrievable.

Communicate Clearly with Employees:

Keep employees informed about payroll schedules, changes, and any issues that may arise. Clear communication helps address concerns promptly and reduces misunderstandings.

Review and Reconcile Payroll Reports:

Regularly review payroll reports for accuracy and reconcile them with financial statements. Consistent reconciliation helps ensure that all payments and deductions are correct.

Implement Error Reporting Mechanisms:

Set up procedures for employees to report payroll errors or discrepancies. Quick resolution of reported issues helps maintain accuracy and employee trust.

Leverage Professional Services:

Consider outsourcing payroll to a professional service provider for expert handling of complex payroll tasks, compliance, and reporting. This can enhance accuracy and efficiency.

By following these tips, businesses can streamline their payroll processes, minimize errors, and ensure timely and accurate compensation for employees.

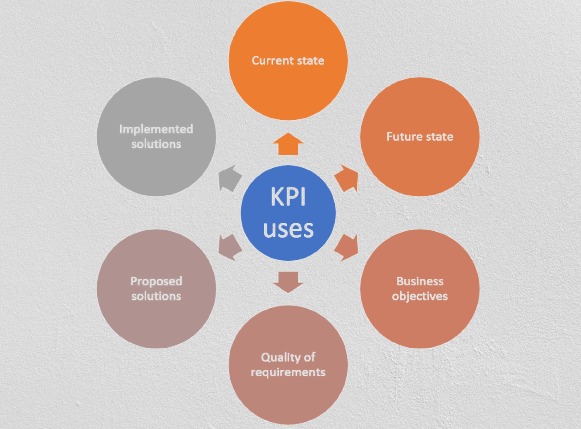

What is KPI in Payroll?

A Key Performance Indicator (KPI) in payroll is a measurable value used to evaluate the efficiency and effectiveness of an organization’s payroll processes. KPIs help track and assess payroll performance to ensure accurate, timely, and compliant payroll operations. Common payroll KPIs include:

-

Payroll Accuracy Rate: The percentage of payroll transactions processed without errors.

-

On-Time Payroll Processing: The percentage of payrolls processed and paid on schedule.

-

Cost Per Payroll Transaction: The average cost associated with processing each payroll transaction.

-

Time to Resolve Payroll Issues: The average time taken to address and resolve payroll-related issues or discrepancies.

-

Compliance Rate: The percentage of payroll transactions compliant with regulatory and tax requirements.

These KPIs provide insights into payroll efficiency, accuracy, and overall effectiveness, helping organizations to identify areas for improvement and ensure smooth payroll operations.

Payroll Compliance Best Practices – Tips to Get It Right

Ensuring payroll compliance is crucial for avoiding legal penalties and maintaining trust with employees. Here are best practices to ensure your payroll processes are compliant:

1. Understand Relevant Laws and Regulations

Stay Updated: Regularly review federal, state, and local labor laws, tax regulations, and industry-specific requirements.

Consult Experts: Engage with legal and tax professionals to ensure compliance with evolving regulations.

2. Implement Robust Payroll Systems

Automate Processes: Use reliable payroll software to automate calculations, tax withholdings, and compliance checks.

Regular Updates: Ensure the software is updated to reflect changes in tax laws and regulatory requirements.

3. Maintain Accurate Employee Records

Comprehensive Data: Keep detailed records of employee information, including tax forms, work hours, pay rates, and deductions.

Regular Audits: Periodically review and update employee records to correct inaccuracies and ensure compliance.

4. Ensure Timely and Accurate Payroll Processing

Regular Schedules: Adhere to a consistent payroll schedule and process payroll on time to avoid delays and compliance issues.

Double-Check Calculations: Verify calculations for wages, deductions, and taxes to prevent errors.

5. Adhere to Tax Requirements

Withholdings and Contributions: Accurately withhold federal, state, and local taxes, and make timely payments to tax authorities.

Tax Filing: File tax forms and reports on time to avoid penalties and interest.

6. Implement Strong Internal Controls

Segregation of Duties: Separate payroll responsibilities among different employees to reduce the risk of errors and fraud.

Access Controls: Restrict access to payroll systems and sensitive data to authorized personnel only.

7. Conduct Regular Payroll Audits

Internal Audits: Perform periodic internal audits to identify and rectify compliance issues before they become significant problems.

External Reviews: Engage external auditors to review payroll processes and ensure adherence to regulations.

8. Provide Ongoing Training for Payroll Staff

Regulatory Training: Offer training sessions on current payroll regulations, software updates, and compliance practices.

Skill Development: Invest in professional development to enhance the skills and knowledge of payroll personnel.

9. Maintain Transparent Communication

Clear Policies: Communicate payroll policies, procedures, and changes clearly to employees.

Address Queries: Provide a system for employees to ask questions and resolve payroll-related concerns promptly.

10. Prepare for Changes and Challenges

Regulatory Changes: Stay informed about upcoming changes in labor laws and tax regulations to proactively adjust payroll practices.

Contingency Planning: Develop contingency plans for payroll processing in case of system failures or other disruptions.

By following these best practices, organizations can minimize compliance risks, enhance payroll accuracy, and ensure smooth payroll services provider in Delhi

Payroll Services in Delhi

ACATL is a leading compliance management company based in Delhi, specializing in comprehensive solutions for regulatory compliance and risk management. Their services ensure that businesses adhere to legal requirements while optimizing operational efficiency and minimizing risks.

Key Features of Payroll Services

Payroll Processing

Calculation of salaries, wages, bonuses, and deductions.

Generation of pay slips and salary reports.

Tax Management

Calculation and deduction of income tax, provident fund (PF), and professional tax.

Filing of tax returns and ensuring compliance with tax regulations.

Statutory Compliance

Adherence to labor laws, such as the Payment of Wages Act, Employee Provident Funds and Miscellaneous Provisions Act, and the Employees’ State Insurance Act.

Filing and management of statutory forms and reports.

Employee Benefits Administration

Management of employee benefits like insurance, allowances, and reimbursements.

Handling of claims and benefits processing.

Time and Attendance Management

Integration with time-tracking systems to manage employee attendance and absences.

Calculation of overtime and shift allowances.

Reporting and Analytics

Generation of detailed payroll reports and analytics.

Monitoring payroll trends and compliance metrics.

Data Security

Protection of sensitive payroll data with robust security measures.

Compliance with data protection regulations.

(FAQs) on outsourcing payroll services:

1. What is payroll outsourcing?

Answer: Payroll outsourcing service in Delhi involves hiring a third-party service provider to manage and process a company’s payroll functions. This includes calculating employee wages, managing benefits, ensuring compliance with tax laws, and handling other payroll-related tasks.

2. Why should a company consider outsourcing payroll?

Answer: Companies often outsource payroll to save time, reduce errors, ensure compliance with regulations, and lower costs associated with maintaining an in-house payroll department. Outsourcing also allows businesses to focus on core activities and strategic goals.

3. What are the benefits of outsourcing payroll?

Answer: Benefits include cost savings, access to specialized expertise, improved accuracy and compliance, reduced risk of errors and penalties, and enhanced data security. It also provides scalability and flexibility in payroll management.

4. What services are typically included in payroll outsourcing?

Answer: Services often include payroll processing, tax calculations and filing, compliance with labor laws, employee benefits administration, time and attendance management, and reporting and analytics.

5. How does outsourcing payroll impact data security?

Answer: Reputable payroll service providers implement robust security measures to protect sensitive payroll data. This includes encryption, secure access controls, and regular audits to safeguard against data breaches.

6. How do I choose the right payroll service provider?

Answer: Consider factors such as the provider’s reputation, experience, range of services, compliance with regulations, technology and security features, and cost. It’s also important to check references and review customer feedback.

7. What should I look for in a payroll service contract?

Answer: Key elements include the scope of services, pricing structure, terms of service, confidentiality agreements, service level agreements (SLAs), and procedures for handling errors or discrepancies.

8. How can outsourcing payroll affect employee satisfaction?

Answer: Outsourcing can positively impact employee satisfaction by ensuring timely and accurate payroll processing, reducing payroll-related errors, and providing employees with access to support and resources for payroll-related inquiries.

9. What happens if there is a mistake in payroll processing?

Answer: Reputable payroll providers have processes in place to address errors promptly. They typically have procedures for correcting mistakes, handling employee inquiries, and ensuring compliance with regulatory requirements.

10. Can payroll outsourcing providers handle complex payroll needs?

Answer: Yes, many payroll outsourcing providers can handle complex payroll requirements, including multi-state or international payroll, varying employee benefits, and specialized tax calculations.

11. How often should payroll be processed when outsourced?

Answer: The frequency of payroll processing depends on the company’s needs and the agreements made with the payroll provider. Common frequencies include weekly, bi-weekly, or monthly payroll runs.

12. How do I transition to a payroll outsourcing provider?

Answer: Transitioning involves choosing a provider, setting up an integration plan, transferring existing payroll data, training staff, and running parallel payrolls to ensure accuracy before fully switching over.

13. What are the potential drawbacks of outsourcing payroll?

Answer: Potential drawbacks include loss of direct control over payroll processes, reliance on the provider for accuracy and compliance, and the need for clear communication and coordination to avoid misunderstandings.

14. Can payroll outsourcing providers help with compliance and audits?

Answer: Yes, many providers offer compliance management services and can assist with audits by ensuring adherence to regulations, maintaining accurate records, and providing documentation as needed.

15. How can I ensure a smooth relationship with my payroll service provider?

Answer: Maintain open communication, set clear expectations, regularly review service performance, provide necessary information and feedback, and address issues promptly to ensure a positive and effective partnership.