Understanding Payroll Compliance: How Payroll Outsourcing Services Help You Stay Compliant

Managing payroll is one of the most crucial and complex tasks for businesses, large or small. Beyond ensuring that employees are paid on time, businesses must also navigate a maze of regulatory requirements and tax laws, collectively referred to as payroll compliance. Failing to adhere to these regulations can result in severe penalties, legal disputes, and damage to a company’s reputation. To mitigate these risks, many businesses opt to outsource their payroll functions, relying on experts to manage compliance efficiently.

In this article, we will explore the importance of payroll compliance, the various regulations businesses must adhere to, and how payroll outsourcing services can help ensure compliance. Understanding these factors is essential for businesses looking to streamline operations and avoid the pitfalls of non-compliance.

What is Payroll Compliance?

Payroll compliance practitioner in Delhi refers to the adherence to laws and regulations governing how businesses compensate employees. This includes the timely and accurate payment of wages, taxes, and statutory deductions, as well as ensuring that proper records are maintained. In India, payroll compliance is governed by various legal frameworks, including labor laws, tax regulations, and social security contributions, among others.

Non-compliance with payroll regulations can lead to serious consequences for businesses, such as penalties, legal action, and loss of trust among employees and stakeholders. Payroll compliance ensures that businesses operate within the boundaries of the law and uphold ethical standards in employee compensation.

Key Payroll Compliance Regulations in India

Payroll compliance in India involves multiple statutory requirements and labor laws that businesses must follow. Below are some of the key regulations:

Minimum Wage Act, 1948

The Minimum Wage Act mandates that employers must pay workers a minimum wage based on their employment sector, skill level, and region. Non-compliance with minimum wage regulations can lead to fines and legal penalties. Payroll systems need to ensure that employees are paid according to the latest minimum wage standards.

Payment of Wages Act, 1936

The Payment of Wages Act ensures timely payment of wages and stipulates that wages must be paid within a specific period, typically on a monthly basis. Payroll systems must ensure that all salary payments are made promptly to avoid non-compliance.

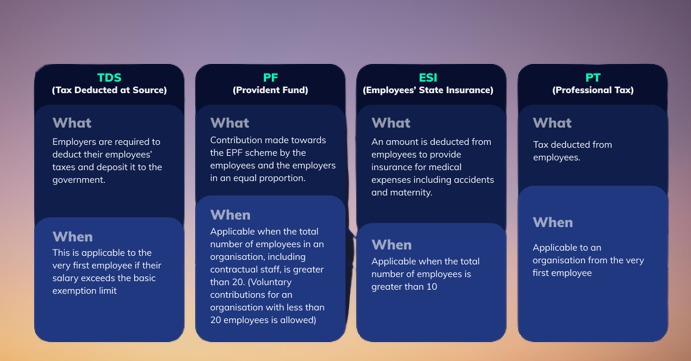

Provident Fund (PF) and Employee State Insurance (ESI)

Employers in India are required to contribute to the Employees’ Provident Fund (EPF) and Employee State Insurance (ESI) schemes. These schemes provide social security benefits such as retirement savings and health insurance. Compliance involves calculating and deducting both employee and employer contributions accurately and on time.

Income Tax and Tax Deducted at Source (TDS)

Income tax laws in India require employers to deduct Tax Deducted at Source (TDS) from employees’ salaries based on their income and applicable tax slabs. Employers are responsible for deducting the correct amount of tax, filing TDS returns, and providing employees with Form 16 for tax filing purposes. Payroll compliance ensures that businesses adhere to these tax regulations.

Bonus and Gratuity

Under the Payment of Bonus Act, 1965 and the Payment of Gratuity Act, 1972, eligible employees must receive bonus and gratuity payments. Payroll systems need to calculate these entitlements accurately, ensuring compliance with the law.

Labor Welfare Fund

Several states in India mandate contributions to the Labor Welfare Fund, which provides social security benefits to workers. Employers must deduct and contribute to this fund as per state-specific regulations.

Maternity Benefits Act, 1961

The Maternity Benefits Act ensures that female employees are entitled to paid maternity leave and benefits. Employers must comply with this regulation by providing the necessary leave entitlements and maintaining accurate records.

The Importance of Payroll Compliance

Payroll compliance is not just about avoiding penalties; it plays a critical role in maintaining a positive business environment. Below are some reasons why payroll compliance is essential:

Avoiding Legal Penalties

Failure to comply with payroll regulations can result in significant legal penalties, fines, and interest charges. These penalties can quickly accumulate, resulting in financial strain for businesses. Moreover, legal disputes can be time-consuming and damage a company’s reputation.

Employee Trust and Satisfaction

Employees rely on timely and accurate payment of wages. Payroll compliance ensures that employees are paid according to labor laws, which fosters trust and boosts morale. Non-compliance, such as delayed payments or incorrect tax deductions, can lead to employee dissatisfaction and attrition.

Business Reputation

Adhering to payroll compliance laws signals that a business is operating ethically and transparently. Companies that consistently meet payroll compliance standards are viewed as responsible employers, which can enhance their reputation among employees, clients, and regulatory authorities.

Financial Stability

Non-compliance with payroll regulations can lead to unanticipated financial liabilities, such as penalties, back wages, and legal fees. By maintaining payroll compliance, businesses can avoid these costs and maintain financial stability.

Challenges in Managing Payroll Compliance

While payroll compliance is essential, managing it in-house can be a daunting task for many businesses, particularly small and medium-sized enterprises (SMEs). Below are some common challenges that businesses face when trying to maintain payroll compliance:

Complex and Evolving Regulations

Payroll regulations are complex and subject to change. Labor laws, tax policies, and statutory requirements are frequently updated, and staying abreast of these changes can be overwhelming. Businesses that fail to keep up with evolving regulations risk non-compliance.

Time-Consuming Processes

Payroll processing is time-consuming, requiring meticulous attention to detail. Calculating wages, taxes, deductions, and contributions takes significant effort, especially when managing a large workforce. Compliance tasks, such as filing statutory returns and maintaining records, add to the workload.

Human Error

Manual payroll processing is prone to errors, such as miscalculations, incorrect deductions, or missed deadlines. Even a small error can lead to non-compliance, resulting in penalties or employee dissatisfaction.

Resource Constraints

Many small businesses lack the resources to dedicate an entire team to payroll management. This can lead to overworked employees, resulting in mistakes and delays in payroll processing. Limited resources also make it difficult for businesses to stay informed about regulatory updates.

Data Security

Payroll data contains sensitive employee information, including salaries, tax details, and personal identification numbers. Ensuring the security of this data is critical for maintaining compliance with data protection laws, such as India’s Information Technology (IT) Act, 2000.

How Payroll Outsourcing Services Help with Compliance

Given the complexities and challenges of managing payroll compliance, many businesses turn to payroll outsourcing services. Outsourcing payroll functions allows businesses to leverage the expertise of third-party providers who specialize in payroll processing and compliance management. Here’s how payroll outsourcing services help businesses stay compliant:

Expert Knowledge of Regulations

Payroll outsourcing providers have in-depth knowledge of payroll regulations, tax laws, and labor requirements. Their teams are trained to stay up-to-date with changes in legislation, ensuring that your business remains compliant at all times. By outsourcing payroll, you reduce the risk of missing important regulatory updates or making compliance errors.

Accurate Payroll Processing

Payroll outsourcing services use advanced software and automation to process payroll with precision. These systems minimize human error by automating calculations for wages, deductions, taxes, and statutory contributions. This ensures that payroll is processed accurately and on time, eliminating the risk of non-compliance due to miscalculations.

Timely Filing of Statutory Returns

Outsourcing providers handle all aspects of payroll compliance, including the filing of statutory returns. They manage the submission of EPF, ESI, TDS, and other required filings, ensuring that all deadlines are met. Timely filing is essential for avoiding penalties and ensuring compliance with government regulations.

Data Security and Confidentiality

Payroll outsourcing services invest in robust security measures to protect sensitive payroll data. These providers use encryption, secure servers, and access controls to safeguard employee information and ensure compliance with data protection laws. By outsourcing payroll, businesses can reduce the risk of data breaches and maintain compliance with privacy regulations.

Customized Solutions for Compliance

Payroll outsourcing providers offer customized solutions tailored to the specific needs of your business. Whether you operate in a particular industry with unique labor laws or have employees in multiple locations, outsourcing providers can design payroll systems that ensure compliance across different regions and sectors.

Cost-Effective and Scalable

For small and medium-sized businesses, outsourcing payroll can be a cost-effective solution compared to managing payroll in-house. Outsourcing providers offer scalable services, meaning businesses only pay for the services they need. As your business grows, outsourcing providers can adjust their services to accommodate an expanding workforce without compromising on compliance.

Reduced Administrative Burden

By outsourcing payroll, businesses free up internal resources that can be redirected toward strategic initiatives and core business activities. The administrative burden of payroll processing, statutory filings, and record-keeping is shifted to the outsourcing provider, allowing your team to focus on driving growth.

Audit-Ready Records

Payroll outsourcing providers maintain detailed records of payroll transactions, statutory filings, and tax payments. These records are organized and easily accessible, ensuring that your business is always audit-ready. Having accurate records on hand can be invaluable during audits or legal inquiries.

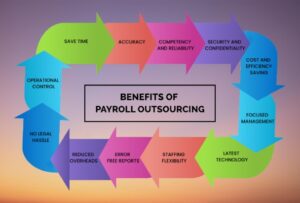

The Benefits of Outsourcing Payroll Compliance

Outsourcing payroll offers several key benefits that go beyond compliance management. Here are some of the advantages that businesses can experience when they choose to outsource payroll:

Improved Efficiency

Outsourcing payroll allows businesses to streamline payroll operations, reducing processing times and improving overall efficiency. Automation and expert oversight ensure that payroll is completed accurately and on time.

Enhanced Employee Satisfaction

When employees are paid accurately and on time, their trust in the organization increases. Payroll outsourcing providers ensure that employees receive correct wages and tax deductions, contributing to higher employee satisfaction.

Risk Mitigation

By partnering with a payroll outsourcing provider, businesses can mitigate the risks associated with non-compliance, data breaches, and payroll errors. Outsourcing reduces the likelihood of penalties, legal disputes, and employee grievances.

Scalability

As your business grows, your payroll needs will become more complex. Outsourcing providers offer scalable solutions that can accommodate an expanding workforce, additional statutory requirements, and diverse payroll structures.

Access to Advanced Technology

Payroll outsourcing providers use cutting-edge payroll software that offers features such as employee self-service portals, real-time reporting, and integration with accounting systems. By outsourcing payroll, businesses gain access to advanced technology without the need for significant investment.

Conclusion

Payroll compliance is a critical aspect of business operations that requires careful attention and expertise. Non-compliance with payroll regulations can lead to severe consequences, including financial penalties and reputational damage. Managing payroll in-house can be challenging due to the complexities of labor laws, tax regulations, and statutory contributions.

Payroll outsourcing services in Delhi offer a comprehensive solution to these challenges. By partnering with an outsourcing provider, businesses can ensure accurate payroll processing, timely filing of statutory returns, and compliance with all legal requirements. In addition to reducing the risk of non-compliance, outsourcing payroll allows businesses to improve efficiency, enhance employee satisfaction, and focus on strategic growth.

At ACATL India, we specialize in providing payroll outsourcing services that help businesses stay compliant with regulatory requirements while streamlining payroll operations. Our team of experts ensures that your business remains compliant, allowing you to focus on what matters most: growing your business.

1. What is payroll compliance?

Payroll compliance refers to adhering to laws and regulations governing employee compensation, including timely payment of wages, correct tax deductions, and statutory contributions like Provident Fund (PF) and Employee State Insurance (ESI).

2. Why is payroll compliance important for businesses?

Payroll compliance is essential to avoid legal penalties, maintain employee trust, uphold the company’s reputation, and ensure financial stability. Non-compliance can lead to fines, legal disputes, and damage to the business’s reputation.

3. What are the key payroll regulations in India?

In India, payroll compliance involves adhering to laws such as the Minimum Wage Act, Payment of Wages Act, Provident Fund (PF), Employee State Insurance (ESI), Tax Deducted at Source (TDS), Payment of Bonus Act, Payment of Gratuity Act, and Maternity Benefits Act, among others.

4. What are the consequences of non-compliance with payroll regulations?

Non-compliance can result in severe financial penalties, legal actions, employee dissatisfaction, and reputational damage. In some cases, businesses may also face audits and long-term financial liabilities.

5. How does payroll outsourcing help with compliance?

Payroll outsourcing providers specialize in managing payroll and ensuring compliance with all relevant laws and regulations. They help businesses by automating payroll processing, ensuring accurate calculations, and handling statutory filings, thus reducing the risk of non-compliance.

6. What are the advantages of using payroll outsourcing services?

Payroll outsourcing offers benefits like improved accuracy, reduced administrative burden, timely statutory filings, access to expert knowledge, better data security, and scalability. It also helps businesses mitigate the risks associated with payroll compliance.

7. What is the role of Provident Fund (PF) and Employee State Insurance (ESI) in payroll compliance?

Provident Fund (PF) and Employee State Insurance (ESI) are mandatory social security contributions that employers must calculate and deduct from employees’ salaries. Compliance involves ensuring these contributions are made accurately and on time.

8. How does payroll outsourcing improve efficiency?

Payroll outsourcing streamlines payroll operations by automating calculations, reducing errors, and processing payroll faster. Outsourcing also frees up internal resources, allowing businesses to focus on strategic activities rather than payroll management.

9. What are the common challenges businesses face in managing payroll compliance in-house?

Businesses often face challenges such as complex and changing regulations, time-consuming payroll processes, human errors, limited resources, and data security concerns when managing payroll compliance in-house.

10. What kind of security measures do payroll outsourcing providers offer?

Payroll outsourcing providers use robust security measures, such as data encryption, secure servers, and access controls, to safeguard sensitive employee payroll data. These measures help businesses comply with data protection laws and ensure confidentiality.